Whether you're wiring funds to Warsaw or making an international transfer to Turin, the chances are that you will need an IBAN to complete the process successfully. Particularly within the European Union, it's the standard for ensuring fast, accurate global money transfers.

What is an IBAN? In short, it's a unique code that helps deliver your funds to a specific bank account overseas. Here's our quick primer on everything you need to know about the IBAN, how it combines with other codes required for an international transfer, and where you can find and use one.

Sending money overseas? Save money when you send money with CurrencyFair's competitive exchange rates.

What does IBAN stand for?

The acronym IBAN stands for International Bank Account Number, so be aware that referring to an “IBAN number” could cause a pedant to fume. It's the brainchild of the International Organization for Standardization (IS0), which established a consistent format in 1997 for identifying overseas bank accounts.

Whereas international money transfers were previously plagued by inconsistencies in account labelling between countries and banks, the introduction of the IBAN offered a simple solution that translated bank account details into a machine-readable alphanumeric format.

Although IBANs are not the only way banks indicate account details, it's the most common method in the European Union and is currently the preferred choice in 71 countries worldwide. As a means of eliminating error, it certainly works. Transaction errors for countries using IBAN now stand below 0.1%.

What is an IBAN number?

The length of an IBAN varies according to country, but the maximum number of characters/numbers is 34. To avoid confusion, only upper case letters are used.

All IBANs begin with a two-letter country code designated by the ISO, followed by a two-digit check number for validation purposes only. These two elements appear on every IBAN worldwide. However, the subsequent parts, which make up the Basic Bank Account Number (BBAN), will vary in the number of characters by country.

The BBAN part of the IBAN continues with a four-digit bank code to identify the institution, the sort code to identify the branch, followed by the account number. Note that whereas the branch code is the same as the first four digits of a BIC (more on that later), the account number entry on an IBAN is not necessarily the same as your usual bank account number. In summary, the IBAN format looks like this:

Country code | Check number | Bank code | Branch/sort code | Account number

How to find an IBAN number?

The most reliable way to obtain the IBAN you need for an international transfer is to go straight to the source. In other words, ask your bank or check a bank statement. Alternatively, you will find online resources such as the IBAN calculator which can build or check an IBAN for you, but there is no guarantee that their results are up to date or accurate.

If you send a transfer using the wrong IBAN either your bank will reject the payment (and charge you a recovery fee) or your funds will end up in a different account to the one you had intended. It's always worth obtaining your IBAN from the bank, not least because the IBAN is only one of the codes you will need to make a cross-border transaction.

What do IBANs have to do with SWIFT codes?

Elsewhere, we've covered the role SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes play in making an international transfer. Similar to the IBAN, the SWIFT code translates unaligned banking details into a standard format. In the case of the 8 or 11-digit SWIFT, that format is:

Bank Code (four characters) | Country code (two characters) | Location Code (two characters) | Branch Code (three characters or sometimes ‘XXX')

Note that the term SWIFT is often used interchangeably with Bank Identifier Code (BIC). Technically, SWIFT refers to the network and BIC to the codes. The important point to consider is that a transfer through the SWIFT network incurs fees (potentially making a bank-to-bank wire transfer up to eight times more expensive than a transfer using CurrencyFair).

If you've spotted the absence of an account number, you've also discovered why a SWIFT/BIC code by itself is not enough to make a transfer. SWIFT codes, which are assigned from a central organisation, identify banks. IBANs, which are created by individual banks, identify specific customer accounts.

As a result, even if you have the SWIFT code for your destination, you will still need an IBAN or individual account details to complete an accurate, secure transfer. For the 71 countries that use IBAN, it's as simple as entering both SWIFT/BIC and IBAN codes in the relevant fields. For those countries that don't typically use IBAN, you will usually require something like a Routing Number (eg. USA or Canada), Indian Financial System Code (IFSC) for India, or whatever code is standard in that destination. That said, most of the countries that do not use IBAN themselves will still receive international payments using an IBAN from banks in countries that do.

How you can save on an international transfer with CurrencyFair

CurrencyFair offers a smart alternative to the fees and searching for codes associated with international wire transfers that use the SWIFT network. In some (but not all) cases*, you can bypass the SWIFT network altogether and avoid the intermediary fees by using CurrencyFair. Here's how it works for a euro to US dollar transfer:

-

You send money into your CurrencyFair account, which will use CurrencyFair's local EUR bank account.

-

Select “Exchange Now” or consult the CurrencyFair Marketplace where you can set your own rate and exchange your euros into US dollars (USD).

-

You'll see US dollars in your CurrencyFair account. Enter the account details for your US recipient (in this case not the IBAN but the routing and account number).

-

We'll send the transfer amount from our local USD account to your recipient, effectively turning an international transfer into a local one.

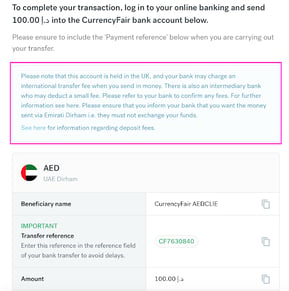

CurrencyFair does have to use the SWIFT network (IBAN required) for some international transfers, but we work to reduce SWIFT's intermediary fees and are always fully transparent if there are going to be any fees you need to know about. You'll be shown a warning like the one below if you will be affected and you can use our estimation tool here as well.

Sending money overseas? Save money when you send money with CurrencyFair's competitive exchange rates.

This information is correct as of 18 January 2021. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. Photo by Thom Holmes on Unsplash.