Anyone planning to move to Australia has a lot of preparation and planning to do in advance of the big move.

Figuring out the visa you will need, finding a job before you go or even sorting your accommodation so you have somewhere to stay when you land.

It is possible to open a bank account before you move overseas and the reasons for doing this could make the transition to your new life easier. The first two weeks after moving to Australia will probably be hectic as you might be on the hunt for more permanent accommodation, enjoying life in your new city or for some expats, trying to find work.

Between arranging apartment viewings, interviews or if you have a job already, working in your new office, your days will quickly fill up and you will need to have money available to do all of these.

Therefore getting your bank account sorted before you go or as soon as you arrive means one less thing for you to think about and will also mean you can start getting paid a lot sooner.

Why open an Australian bank account before you move:

Opening your bank account before you move to Australia will mean:

-

Having money or evidence of funds for your first month rent or a deposit.

-

Having money for day to day expenses.

-

Having money to pay for transport or if you need to extend your stay in a hostel or hotel.

We look at the steps to open a bank account in Australia before moving there.

What are the main banks in Australia?

The four main banks in Australia that you can open an account online with are:

- ANZ

- Commonwealth

- NAB

- Westpac

What are the types of bank accounts in Australia?

There are three types of bank account you can open in Australia:

-

Everyday Transactions Account: for day to day expenses.

-

Savings Accounts: is goal based and offer flexible saving terms.

-

Term Deposit Accounts: are where you invest savings for a fixed amount of time and a fixed rate of return.

-

Credit Account: after some time in Australia building a healthy credit history, you might be eligible to apply for a credit card to be able to purchase things and pay for them later.

Do you need to provide your Tax File Number to open a bank account in Australia?

It is advised to provide your TFN as soon as it is available to ensure you do not get taxed more than you should. You do not need a tax file number to open an account. However if you open an account without giving a tax file number, then, any interest earned in that account will have tax deducted at the top rate, around 50%. You can apply online with the Australian Tax Office for your TFN here before you move - however you do need an Australian address to do this so having accommodation or a place to stay before you move is advised to get this.

Opening an Australian bank account before you move

One way to plan ahead is to open a bank account before you move to Australia. The leading banks in Australia are ANZ, Westpac, Commonwealth and NAB - also known as the “big four”. All offer this option to migrants planning on moving Down Under within the next 12 months.

Just remember to have the necessary documentation outlined above. Until you have your identity verified, you will not be able to withdraw any funds from your account.

How do I verify my identity with the Australian banks

Any new customer that opens an account with an Australian bank (including expats and native Australians) must have their identity verified in order to be able to withdraw funds from your bank account.

The documentation required varies but there are standard documents you require for the Big Four, which are a combination of:

- Primary IDs with or without a photo for example passports, government issued ID cards or birth certificates.

- Secondary IDs include for example licenses with no photos, marriage cert or utility bills.

Remember: You can still open an account if you’re on a working-holiday visa, a student visa or another type of temporary visa. You don’t need to be a permanent resident or citizen.

However anyone moving to a new country would most likely be bringing any of the above documentation with them anyway so an expat moving to Australia will definitely have their passport and might even have packed their birth cert or maybe even their driving license with them.

Dedicated Australian Migrant bank accounts 2018

The “Big Four” now offer dedicated bank accounts for migrants planning on moving to Australia.

However it is always worth investigating all options or shopping around when you are settled to make sure you are getting the best available rates on your bank account.

WestPac Choice - is an account you can open if you are arriving in Australia in 12 months and intend to make a deposit within 6 months. With this account, holders must complete their identity check within 12 months and won’t be able to make withdrawals until they have completed this check. Westpac's offshore offices (for example in London) can “verify” you so that when you arrive in Australia you can start accessing your funds.

Nab Everyday Bank Account - can be opened online and with a passport and email address. You can transfer funds to your new account up to 12 months prior to your arrival. You can also apply for a savings account with them. NAB also have dedicated migrant support teams in New Zealand, the UK, India, Hong Kong and Singapore to help you before you move.

Commonwealth Everyday Account Smart Access - this account can be opened by anyone moving to Australia to work or study. Open your account instantly online up to three months before you arrive in Australia however you must be identified in branch before you can withdraw funds.

ANZ Access Advantage - With this account you can open a bank account before you leave home, either online or through one of its regional contacts in your country. This means you can transfer money before you arrive in Australia. They also offer UK-based relationship managers.

If you are interested in other ways to start savings, check out our article on the apps that could save expats money.

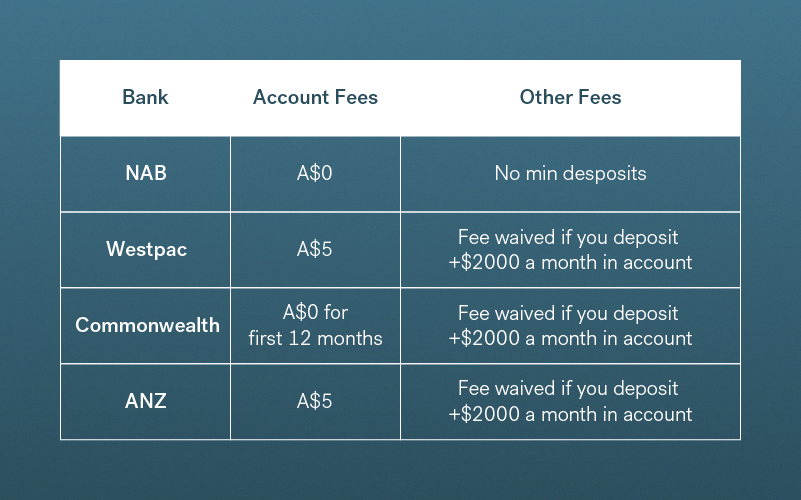

Fees charged with Australian migrant bank accounts

This section is intended as a general guide for reference only. The account types and fees listed were calculated on August 24th 2018 and are subject to change. Please check the individual bank websites for the latest fee updates and further information.

Moving overseas is an exciting time however you have a lot of work to do as well as the organisation of leaving your old life behind. Having one less job to do after you move will make your arrival and the transition to your new life overseas that bit easier.

If you need to transfer funds to Australia for your move there, with CurrencyFair it is up to 8x cheaper to send money than with a typical bank.

Best of all you can transfer your AUD into your new Aussie bank account for just A$4 - not bad!

Banks hide their fees in poor exchange rates, often charging as much as 3%-6% in excessive margins. CurrencyFair is around 0.45% away from the interbank rate meaning it's up to 8x cheaper for you to transfer money to and from Australia with CurrencyFair.

CurrencyFair is ideal for expats who need to:

-

Send regular savings home.

-

Relocate and setup expenses.

-

Make mortgage payments and other property expenses.

The information contained in this article should not be relied upon as a substitute for professional advice in individual cases. Future changes in legislation, tax level, and practice could affect the information in this site. The information shown is based on date or information obtained from sources believed to be reliable but CurrencyFair makes no representation and accepts no responsibility as to its accuracy or completeness and will not be held liable for damages arising out of any person's reliance upon this information.