Any foreigner can buy property in Greece. With the United Kingdom (UK) economy facing some “difficult decisions aheadâ€, many UK homeowners and investors might well ask themselves if now is the time to capitalise on steadily rising prices and rental incomes in Greece. We can't advise on whether you should, but we can explain how you could.

If you need to exchange currency for a deposit on a Greek property, you should be aware of hidden bank fees and fluctuating exchange rates. With great rates and minimal fees, CurrencyFair's safe, reliable service saves you money, leaving you with more cash to spend on your ideal Greek home.

How many UK expats are there in Greece?

More than 17,000 British expats currently live or own property in Greece. That might not put it among the top 10 destinations for UK expats, but there's some fierce European competition from Italy, France, Spain, and Germany after all. Nevertheless, Greece is firmly on the radar and growing in popularity as an investment alternative to more saturated markets elsewhere.

Why buy property in Greece?

If you're looking for some balmy Mediterranean living, Greece has more than 300 days of sun a year, 230 habitable islands, a famously healthy cuisine, and a historical legacy that boasts 18 UNESCO World Heritage sites. It might not be one of the cheapest countries to live in globally, but you can certainly upgrade your quality of life if you're moving from the UK.

If you're investing, on the other hand, the attraction is a resurgent property market with some generous tax exemptions on offer to foreigners, property owners, and retirees. Having suffered a catastrophic economic crash in 2008, Greece is actively seeking overseas investors. For now, at least, the attitude towards foreign buyers is welcoming and collaborative.

Tax matters

As in most countries, if you're staying more than 183 days in Greece within a given year, you'll be treated as a tax resident. At that point, all your global income is taxable. Should you choose to remain in the UK, however, and rent out a Greek property, you'll only pay tax on your rental income, which ranges from 15% (for income up to €12,000 per year) to 45% (for income over €35,000 per year).

You'll also be liable for Uniform Real Estate Property Tax (ENFIA) which is based on the size of the property and ranges from €0.001 to €13 per square metre.

Key differences between UK and Greek property

Language is less of a factor than you might expect. An estimated 51% of Greeks can speak English, so you shouldn't struggle to find a local real estate agent and notary.

Currency does matter, however. Greece has had a turbulent relationship with the euro since joining the single currency in 2001. While the economic outlook has stabilised, euro parity means that UK investors transferring pounds sterling have less spending power, but any rental income would be worth more.

A subtle difference between the UK and Greek property market is that home ownership is higher in Greece. Roughly 75% of homes in Greece are owner-occupied, compared to 65% in the UK. At the same time, the holiday rental market in Greece arguably has more exciting opportunities.

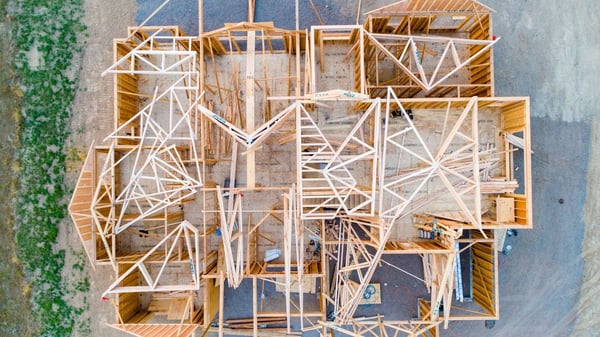

When it comes to housing stock, most foreign investors favour new builds over the secondary housing market, where the conditions can be poor.

Greece Golden Visa

Since Brexit, UK investors are now non-European Union (EU) residents, which means they face residency restrictions that EU citizens don't. UK buyers will need to apply for a residence permit to stay longer than 90 days, but there's a better option. In 2013, Greece introduced a golden visa programme which grants permanent residency to investors and their families. The initiative has brought more than €2 billion in foreign investment into the country since it was introduced in 2013.

4 advantages of buying property in Greece

As you're compiling your shortlist of where to buy an overseas property, you'll find your attention drawn repeatedly to Greece for these reasons in particular:

Solid returns

You could be house hunting in one of the ten most attractive European investment markets according to EY Greece. For investment properties, a solid annual yield ranging from 2% to 10%, depending on the location and property type, is perfectly achievable.

Promising market

By historical standards, “cheap†properties are still in abundance in Greece. Prices hit their all-time high in 2008 before the crash. In 2022, average property prices are still 25% lower than this peak, so there's potential for growth. And if you're comparing it to Spain, prices are some 35% lower on average.

Low upfront costs

Compared to the UK, acquisition costs (taxes and notary fees) are low, typically adding no more than 5% to the sale price. Real estate commission and legal fees are relatively low too.

Reclaim EU citizenship

If you're taking the golden visa route, you can apply for residency after five years and citizenship after seven, offering a route back to EU citizenship and all the benefits of free movement across the Schengen Area.

Risks of buying property in Greece

You might decide to call off your homebuying odyssey once you've considered the following disadvantages of buying property in Greece:

High upkeep costs: this applies less to new developments, but pre-lived properties in Greece can often have structural or maintenance issues that you'll be responsible for repairing as the owner.

Scams: as an overseas buyer, you're an easy target for unscrupulous sellers who can collude with real estate agents in a language (and alphabet) that you're probably still learning.

Slow bureaucracy: compared to the frantic pace of UK sales, the homebuying process in Greece is longer and the paperwork plentiful. The World Bank ranked Greece 156th out of 190 countries when it came to the ease of doing business.

Economic volatility: between 2008 and August 2017, Greek property prices fell by 40%. That might spook first-time investors, but seasoned buyers might see an opportunity. Prices are certainly on the up, with a 6.1% rise in the price of apartments in Greece in 2021, a year in which foreign investment totalled almost 800 million euros.

Lending barriers: since the economic crash, it's become almost impossible to get a mortgage from a Greek lender as a foreigner. Most buyers are using the proceeds of a UK house sale.

Tenancy restrictions: rental contracts have a fixed duration of three years, after which the contract automatically ends unless both parties agree to continue. Some landlords may find that too inflexible. Likewise, certain building codes impose restrictions on short-term rentals, especially as an Airbnb.

Top Greek property hotspots

Tourists will be most familiar with the Greek islands of Corfu, Crete, and Rhodes (where there are large expat populations), as well as the capital Athens on the mainland.

Median property price per square metre, courtesy of Residence Greece

-

-

-

Athens (city centre) €1,922

-

Corfu €1,540

-

Crete €2,000

-

Thessaloniki €1,872

-

Santorini €4,500

-

(National average €1,626)

-

-

How to buy property in Greece

Once you've scoured the property listings online, hired a local agent, and found your dream home, you'll need to:

-

-

-

Obtain a tax number via the nearest Greek tax office (Eforia). This is needed not just for paying taxes but also for making large foreign transactions.

-

Open a local euro bank account.

-

Check the title to the property with the Greek Cadastre/Land Registry.

-

Get the sale agreement signed at a local notary.

-

Receive the certificate of ownership from the Land Registry.

-

-

Do's and Don'ts for buying property in Greece

Buying a property in Greece can be a marathon, but you can avoid a tragedy if you follow these tips:

-

-

-

Use a local real estate agent, notary and tax agent who understands the nuances and formalities of the Greek property market. It's not a legal requirement to use a Greek solicitor, but you must use a Greek notary, accountant, and land surveyor.

-

Invest in a full structural survey from a civil engineer. Building regulations tend to be more rigorous for all homes built after 1985, but the country is susceptible to earthquakes and there may be some serious structural flaws behind those beautifully whitewashed walls.

-

Be ready to make a 10% deposit to reserve your chosen property, and to pay a 3% property transfer tax once you complete the sale.

-

Don't forget to file your tax returns in Greece. As a property owner, you'll need to fill out form E9 even if you're living abroad.

-

Don't give cash or wire a large sum directly to a seller. That may seem obvious, but it's easy to behave irrationally if you're being pressured into securing a dream property by a convincing scammer.

-

-

If you need to exchange currency for a deposit on a Greek property, you should be aware of hidden bank fees and fluctuating exchange rates. With great rates and minimal fees, CurrencyFair's safe, reliable service saves you money, leaving you with more cash to spend on your ideal Greek home.

This information is correct as of November 2022 This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. Photo by Dimitris Kiriakakis on Unsplash