The Australian housing market is booming, expat buyers are welcome, and foreign investment in Australian real estate continues to grow. Although certain restrictions apply, foreigners are entitled to buy property Down Under and enjoy their place in the sun.

That's the dream for expat buyers from the United Kingdom, China, New Zealand and India in particular. These are the top four when it comes to buying a house to settle in Australia as a permanent resident. Not all buyers are planning to relocate, however. Australian real estate remains an attractive investment proposition that is popular with buyers from the United States, Canada, Singapore, Hong Kong and China. In 2019-20 financial year, AU$14.8 billion of residential property was sold to expat buyers.

Planning on buying property overseas? Avoid hefty markups on exchange rates when buying and selling overseas real estate with CurrencyFair's low-margin FX rates.

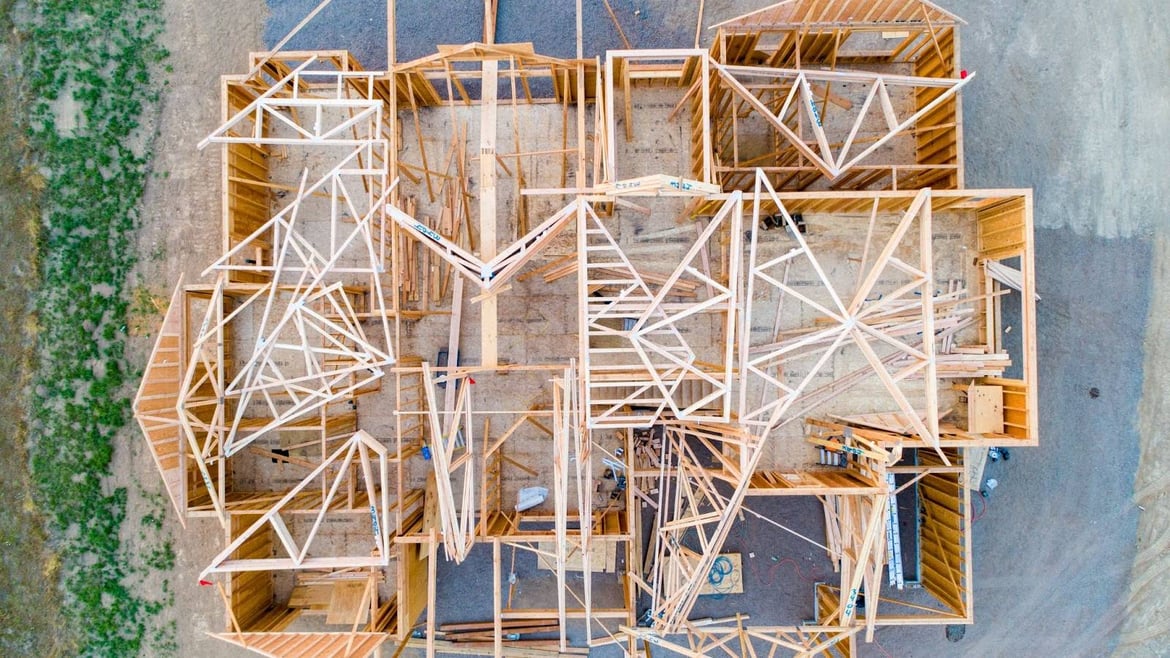

What types of property can foreigners buy in Australia?

Restrictions imposed in 2015 on foreign buyers of Australian property are designed to protect the housing market from speculation and support the construction industry. Note that these restrictions apply only to buyers who are resident overseas or temporary residents in Australia. Permanent residents enjoy much the same rights as Australian citizens.

Foreign buyers may buy only:

-

New buildings, for which the approval process is typically fast and straightforward.

-

Vacant land, as long as construction is planned and completed within four years.

-

An existing building, providing the plan is to demolish it and rebuild a greater number of properties in its place.

-

An established dwelling in which to live as a temporary resident. The property must be sold, however, when you leave Australia. It cannot be rented out in your absence.

We've covered some of the broader considerations about visas, banking and finding the right real estate agent in our guide to buying property in Australia. Whatever else is on the to-do list, the first step for any expat buyer is to secure approval from the Foreign Investment Review Board (FIRB).

FIRB application and approval

Foreigners (apart from New Zealand citizens and permanent residents) must apply to the FIRB for approval to buy. This should be completed before any other paperwork is signed or money changes hands. The purpose of the FIRB is to drive investment in new builds rather than existing inventory, spurring growth in the construction sector and increasing housing supply as a result. Reforms in 2021 also introduced a National Interest Test to the approval process. Although this test should not cause undue concern to the typical expat home buyer, there is the potential for a purchase to be blocked where it is against the national security interest.

How to apply

To start the FIRB approval process, go to the Australian Tax Office (ATO) portal and select the ‘Foreign Investment in Australia' option. Fill out the fields, submit the form and pay the fee. The FIRB fee depends on the purchase price of the property and ranges from AU$5,800 for houses under AU$1million to AU$106,000 for houses over AU$10 million. Once your application is submitted, you should receive a decision within 40 days by law.

Caveat Emptor!

The FIRB upgraded its policies in 2021. If you now buy a property as a foreigner without FIRB approval, you can face heavy fines or up to 10 years in prison. These penalties also apply if you fail to start construction on land within the four-year period or fail to sell the property if you're leaving.

Why invest in property in Australia?

There's more than the climate, outdoor lifestyle and natural beauty luring expats Down Under. A stable and well-regulated real estate market is a big draw too. Australian properties have enjoyed consistent capital growth over the last 100 years, with median property prices increasing by 70% nationally over the last ten years, according to Australian Bureau of Statistics figures. Because Australia has a high proportion of homeowners (around 70%), speculation and housing bubbles are less of an issue than in some other more volatile international markets.

For expats who settle as permanent residents, the best places to live in Australia take their cue from the major financial and business hubs. Not surprisingly, 87% of expats head to the major cities, particularly in New South Wales (NSW) and Victoria.

The hottest real estate markets include the ‘million dollar suburbs' of Sydney, Melbourne and Brisbane, where housing affordability is a growing concern. Western Australia (WA) typically offers the most affordable option according to the Real Estate Institute of Australia. For reference, the average home loan amount in June 2021 was AU$430,805 in WA, compared to AU$705,658 for NSW.

Can you get a loan to buy property in Australia as a foreigner?

One of the perennial challenges of purchasing real estate abroad is that lenders will inevitably treat foreign buyers as high risk. In Australia, it is difficult to get a home loan unless you are an Australian citizen or permanent resident. If you can find a lender, expect to pay a higher deposit and substantially higher interest rates. Nevertheless, there are no formal barriers in place to stop you applying for a loan.

Overseas buyers can apply for the First Home Owner Grant. The scheme is administered by each state, so eligibility requirements will vary, but permanent residents can usually secure a one-off grant for new homes only.

Can I get permanent residency as a homeowner in Australia?

Temporary residents in Australia (there are currently around two million) who wish to settle as permanent residents will have to apply for a skilled worker or family member visa. The Australian government granted 140,366 permanent skilled and family visas in 2019-20, using a points-based system. Owning a property does not confer any special privileges as far as residency is concerned. There is a retirement pathway, but it is open only to “long-term residents who have contributed to, and are well-established in the community.â€

Planning on buying property overseas? Avoid hefty markups on exchange rates when buying and selling overseas real estate with CurrencyFair's low-margin FX rates.

Photo by Avel Chuklanov on Unsplash

This information is correct as of 21 October 2021. The information is not to be relied on in making a decision with regard to an investment. The article is purely for general information purposes.