The process of sending money to or from the United Kingdom (UK) is surprisingly straightforward for businesses, but watch out for hidden fees and currency conversion rates. Banks and payment service providers have to meet stringent funds transfer regulations to comply with the Financial Conduct Authority (FCA) and HM Revenues and Customs (HMRC). Still, they are under no obligation to deliver a competitive exchange rate or fee-free transfer.

The main international money transfer regulations to navigate are designed to support anti-money laundering (AML) initiatives and combat fraud. The task is big. The UK is the world's second-biggest money-laundering hotspot, with £88 billion laundered annually, while financial fraud costs the UK more than £130 billion a year.

How much can you send abroad from the UK?

There is no legal limit on how much you can send abroad from the UK. However, individual banks will have their own daily limits for wire transfers, ranging from £50,000 for HSBC to £100,000 for Barclays (business) and Lloyd's.

Although the UK is no longer subject to European Union (EU) AML regulations, the Sanctions and Anti-Money Laundering Act retains the spirit and rigour of EU regulation. Payment service providers must conduct Enhanced Due Diligence (EDD) on transfers to high-risk countries or business sectors.

From the customer perspective, that typically means having to provide full details of the payer and payee for any international transfer, including:

- Full name.

- Address linked to your bank account.

- IBAN number.

For international transfers from the UK to the EU, the payment service provider must verify the above information for both the payer and payee where the transfer is over �1,000 or where cash is involved. As well as preventing money laundering, these regulations are also intended to weed out foreign money transfer scams in which fraudsters set up bogus companies or use stolen identities to receive money.

Banks in the recipient country may also require supporting evidence as to the source of funds. Prepare to share receipts from the sale of goods, bank statements, property sale contracts or loan agreements to prove that transfer funds come from a legitimate source.

How much can you receive in the UK?

While there are limits to how much cash you can bring into the UK - currently up to £10,000 - without declaring it, there is no such limit on how much you can receive by wire transfer. There are tax implications to consider, nonetheless.

As a rule of thumb, if you are “domiciled” in the UK for tax purposes, you will have to pay tax on any sums transferred from overseas to the UK.

As with transfers overseas, most banks set their own daily limits for receiving funds. To receive money from overseas, you will need to provide the sender with your full name, address, IBAN number and your bank's SWIFT/BIC code.

Tax liability for international transfers to the UK

There are numerous scenarios where funds transferred to the UK from sources of overseas income are liable to tax, including income from working overseas, foreign investments, property rental or sale income, and overseas pensions income.

Exemptions may be possible if there is a double taxation treaty in place and tax has already been deducted overseas, but in principle UK residents are liable for tax on worldwide earnings.

If the funds are from repatriating your own existing assets there is no tax liability. It is only when the funds are considered as income, for example, if you're trading internationally or paying employees and suppliers overseas that the interests of HMRC will be aroused.

In 2018, HMRC enacted “requirement to correct” rules to bring the UK in line with the Common Reporting Standard. You must now notify HMRC of any offshore bank accounts you hold that receive income.

Bear in mind that UK tax residency and non-domicile status rules are nuanced. See professional financial advice to establish your own particular tax liability.

Important information for international money transfers

Regulations for international transfers were updated following Brexit, and payment service providers must now comply with updated Funds Transfer Regulations. Under confirmation of payee rules introduced in 2020, you can ask the sender to verify that the name of the person you are sending to matches the name on the bank account. If verification is not possible, you can stop the payment.

There are numerous options available for sending or receiving an international transfer. Avoid using any payment service provider not registered with the FCA.

Banks

The value of global cross-border payments is expected to reach US$250 trillion by 2027 and the vast majority of these transfers are made via high street and investment banks. Safety and convenience are the main advantages.

You can usually set up a transfer in minutes (although the actual transfer can take longer) through your bank's secure online portal or by phone banking. The downside is that banks charge relatively high fees for international transfers, and typically set their exchange rate just once a day.

For large transfers, in particular, that can mean exposing yourself to considerable currency fluctuation against the real-time market rate, and it's why any business that regularly sends or receives international transfers must have a currency risk management strategy in place.

Payment service providers

High street money transfer services such as Western Union offer a valuable money transfer resource for the unbanked or those who want the convenience of a peer-to-peer money transfer in seconds via mobile app, for example.

These providers typically charge high fees for the service and will usually offer less competitive currency exchange rates. You will need a valid passport, driver's licence or some other form of government-issued identification to send or receive money and daily limits are lower.

International multi-currency accounts

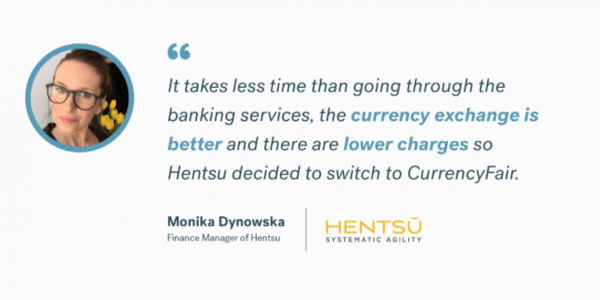

An increasingly popular option is to use an international cross-border payment service such as CurrencyFair. CurrencyFair was launched in Ireland in 2010 and offers an online cross-border payment and foreign exchange service to customers globally.

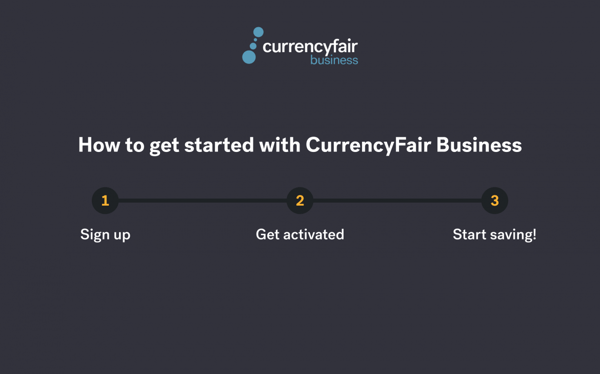

To send money internationally from the UK, you can sign up for a CurrencyFair business account or download the CurrencyFair mobile app on Android or Apple. After your account is activated, you will be able to send and receive international payments.

With a CurrencyFair business account, you can access competitive FX rates, low-cost international transfers, and 24-hour customer support. CurrencyFair's business account customers can exchange over 20 currencies and send and receive international money transfers to and from over 150 countries. You also have the ability to set up custom roles with multi-user access and two-person approval to handle the scaling FX needs of a growing company.

The platform lets you trade in two ways; exchange currencies immediately or set the exchange rate you want, wait for your trade to be matched and get a better rate using the CurrencyFair Marketplace. CurrencyFair also offers an integration with Xero, an online accounting software, allowing you to effortlessly reconcile payments.

Send money internationally from the UK at rates up to eight times cheaper than a traditional bank, with no hidden fees. Whether you need to pay global employees and suppliers, or receive payments for international invoices, save on your currency exchange with CurrencyFair.

This information is correct as of June 2022. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. Photo by Joshua Miranda.