If your business needs to send money abroad from the United Kingdom, it's worth reviewing your options for international money transfer companies.

You could send money abroad with your bank, or use the post office's international money transfer service, but these options are rarely the cheapest. Cost isn't the only factor, money transfer companies will often have specialised business accounts with features and integrations that make handling overseas payments easier. When you need to pay overseas suppliers or employees or receive international payments, there are additional services available to streamline operations and boost your bottom line.

How much does it cost to send money abroad from the UK?

The cost of your transfer will differ depending on the method you choose, the country you send it to and whether you need to exchange currency in the process. The mid-market rate is the rate that banks and other transfer providers are able to buy currency based on the large quantities they buy. Money transfer companies operate by charging an additional margin to the mid-market exchange rate, transfer fees or a combination of both. For a more detailed look at sending money abroad and what impacts those costs, check out our guide: Sending money abroad: a guide to international money transfers.

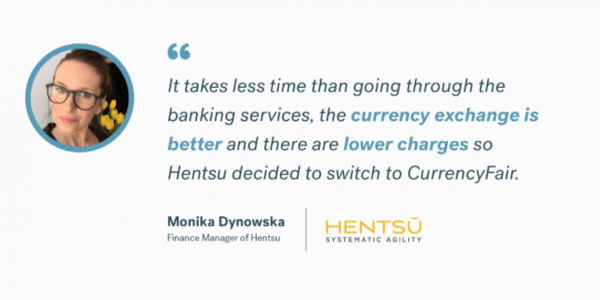

CurrencyFair offers an online cross-border payment and foreign exchange service in over 20 currencies and 150 countries. With world-class customer service and a 4.6/5 rating from over 5,600 customer reviews on TrustPilot, CurrencyFair is up to eight times cheaper than sending money abroad with a traditional money transfer provider, like a bank. You can access great exchange rates in the UK from any device, at any time, and see the final amount your exchange will cost up-front using our currency calculator.

Money transfer companies in the UK compared:

Currencies Direct

Currencies Direct, formed in 1996 in the UK, has 20 branches in Europe, USA, India and South Africa. It facilitates incoming and outgoing payments in 40 currencies, and business accounts can be opened to collect sales made in the UK, USA, France, Germany, Spain, Italy and Japan.

When comparing international money transfer providers, their exchange rates may be one of the first things you consider as this will directly impact the cost of sending money abroad. While its FX conversion rates are not instantly available on its website, Currencies Direct does offer to send you a quote for its conversion rate if you provide your contact information.

Its business account facilitates multi-currency accounts, and the option to upload files from your accounting software for batch payments. Currencies Direct offers risk management solutions and financial guidance for its business account customers.

There's a 0.1% fee applied to all funds collected in your Currencies Direct account, which is included in your exchange rate but will appear separately on your statement.

Currency Solutions

Currency Solutions was formed in 2003 and is headquartered in London. It offers FX solutions, risk management, cross-border payments and an online trading platform for its business account customers.

Its exchange rates are not available on its website, once you have opened an online account you must contact them with the currencies you want to exchange and receive your quote that way.

While you can trade using its online platform, there's a £50,000 transfer limit to send money online for business accounts and larger transactions must be handled over the phone. With regard to transfer fees for business accounts, Currency Solutions charges £10 for transfers under £3,000, and it removes the transfer fee for exchanges over £3,000.

Moneycorp

Moneycorp was founded in 1979 and is headquartered in London. It facilitates trades in 30 currencies online and 120 for transfers handled over the phone.

It offers foreign exchange solutions like online multi-currency accounts, spot contracts, international payments, and risk management for business account holders.

In terms of moneycorp's fees and exchange rate markup, it charges £15 to make international payments by phone and no transfer fee for its online platform. However, its exchange rate is not available on its website - the rates displayed are the or mid-market rate, and indicative only.

OFX

OFX is a money transfer service founded in Australia in 1998. It offers international transfers in 55 currencies, to over 190 countries.

Its business account customers can access an integration with Xero, a cloud-based accounting software platform, that invoices in foreign currencies and synchronises transactions.

You have to create an account and log in to see the exchange rate offered by OFX, the rates displayed on its website are the mid-market rate as a reference point.

Revolut

Revolut, founded in 2015, is a British financial technology company. Revolut operates seven tiers of subscription-based business accounts. Fees depend on the account type, the margin you want to be charged and your allowance - the number of free payments you can make to various categories of recipients. A 0.4% fee is applied to any exchange above your free allowance according to your plan. It offers multi-currency accounts and supports transfers for over 30 currencies.

Monthly fees vary for features like priority customer support, and fees for adding team members beyond your allowance, as well as international transfer and FX fees and card payments. These fees can be viewed on its website. Its FX fees vary depending on your plan, and to ascertain if these are added or removed from the final cost you need to create an account.

TorFX

TorXF is headquartered in Cornwall and was founded in 2004. It is owned by Azibo Group, a private investment company that also owns Currencies DIrect.

It offers online transfers 24/7 up to £100,000, and business account customers can access spot contracts, forward contracts, market orders and market insights from a dedicated account manager.

Its exchange rates are not available on its website, but you can request a quote by entering your business and contact details or call them for the information.

TransferMate

Established in 2010, TransferMate is part of the global financial services company TaxBack Group. TransferMate is a B2B-payments technology company, and its offerings include payments, foreign exchange, global accounts and receivables.

Its business account features include the ability to book live FX rates instantly and the option for bulk payments that allow business customers to make up to 10,000 payments at one time. The rate calculator on its website shows the mid-market rate for informational purposes only, in order to find out its actual exchange rate you have to contact its team.

Western Union

Western Union is one of the largest remittance companies in the world, with over 500,000 agent locations. Its exchange rate changes depending on the delivery and payment method you choose. Its fees vary depending on a range of factors, such as the destination country you're sending to, the way you pay for your transfer and the way you want your recipient to get the money.

With Western Union Business Solutions, it offers a variety of FX risk management and hedging options and a digital payments platform that facilitates payments to over 200 countries and territories and more than 130 currencies. Business customers can also avail of accounts payable and invoice integration as well as mass payments.

Western Union Business Solutions FX rate calculator only displays the mid-market rate and doesn't account for “the spreads, handling fees, and other charges” associated with using Western Union for overseas money transfers.

Wise

Wise is a money transfer provider headquartered in London. Depending on how quickly you need the funds to reach the recipient, you can opt for different tiers of transfer speed with different costs. A Wise business account offers international payments and the ability to pay invoices, buy inventory, and handle payroll in over 50 currencies.

Key business features include an integration with accounting tools such as Xero, batch payments to make multiple payments in one go, open API to automate payments and workflows and monthly statements available to download for balances you hold. It does not currently offer FX hedging options.

WorldFirst

WorldFirst, founded in 2004, offers international payments in 68 currencies.

Its business accounts include spot contracts, forward contracts and firm orders. It also provides mid-market analysis updates, international payments online, by email or over the phone and a bulk payments facility.

For business clients, the fee structure is based on the amount of business done. Fees range from £0 to £15 per transaction. The firm offers tiered pricing where you receive a fixed spread based on your annual trading volume. WorldFirst's FX calculator only displays the mid-market rate, in order to check the actual rate and fees you must create an account or contact them.

CurrencyFair

Founded in 2009, CurrencyFair has offices in Ireland, the United Kingdom, Singapore, Hong Kong and Australia.

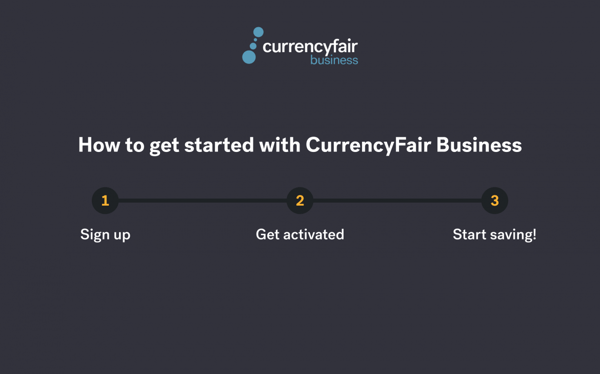

With a CurrencyFair business account, you can access competitive FX rates, low-cost international transfers, and 24-hour customer support. CurrencyFair's business account customers can exchange over 20 currencies and send and receive international money transfers to and from over 150 countries. You also have the ability to set up custom roles with multi-user access and two-person approval to handle the scaling FX needs of a growing company.

The platform lets you trade in two ways; exchange currencies immediately or set the exchange rate you want, wait for your trade to be matched and get a better rate using the CurrencyFair Marketplace. CurrencyFair also offers an integration with Xero, an online accounting software, allowing you to effortlessly reconcile payments.

Our exchange calculator, available on our website without having to set up an account, shows you the actual exchange rate available to our customers, not just the mid-market rate with a hidden mark-up. It also includes our transfer fee of £2.50 (or its currency equivalent), which stays the same no matter how much you exchange.  This information is correct as of April 2022. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. Photo by Olga Lioncat.

This information is correct as of April 2022. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. Photo by Olga Lioncat.