Foreign exchange and international money transfers don’t have to be expensive, but when exchanging currencies with traditional banks, sending money abroad can be a costly affair riddled with marked-up FX rates, hidden transfer fees, and jargon-laden terms and conditions.

CurrencyFair was founded as a challenger to traditional banks over a decade ago by a group of expats looking for a low-cost, simple way to move money across borders. CurrencyFair’s founders set out to democratise foreign exchange and ensure that everyone, regardless of how much they’re exchanging, could access rates traditionally reserved for large businesses and brokers.

Although our community has grown substantially since our founders first built the platform in 2009, our mission remains the same - to empower them all with access to fair financial services. Since we started, we’ve securely exchanged over €10 billion (or currency equivalent) and our customers have saved over €260 million.

Here are just a few ways our customers use CurrencyFair to save on life’s bigger events such as paying overseas mortgages, to the things that matter most such as transferring money home to family.

Sending money home or abroad

It can be very costly to send money abroad. Some money transfer companies promise fee-free transfers, speedy process times, and low-margin foreign exchange rates. Unfortunately, these fantastic offers are often underpinned by hidden fees, sneaky charges, inflated exchange rates, and the purposeful use of inaccessible language in their terms and conditions.

With CurrencyFair however, what you see is what you get.

On average, CurrencyFair only adds 0.45% to the mid-market currency exchange rate, whereas traditional banks can add markups of between 3% and 6%. Our transfers are always €3 (or equivalent), so your fee doesn’t snowball even when a significant amount of money is being exchanged.

Martha Loughlin trusted CurrencyFair with her savings when emigrating to Canada from Ireland and by accessing our low-margin rates, she had more money to fund her new start in Canada.

Embarking on a new adventure abroad

If you’re a globe-trotter, you’ll likely be familiar with the feeling of being short-changed by the bureau de change booths at airports.

Even if there is no service fee, you will have to shell out for markups hidden within the exchange rate itself. For example, International Currency Exchange at Dublin Airport offers an exchange rate of €1 to £0.8501, whereas CurrencyFair offers a rate of €1 to £0.9007 (comparison carried out on 13 October 2020 at 11:48).

Instead of going through the hassle of ordering and collecting currencies at an airport, hold over 20 currencies in your CurrencyFair multi-currency account and exchange to the currency you need, when you need it from any device, at any time. You won’t have to worry about keeping your physical currencies separated into two cumbersome wallets because with CurrencyFair, your currencies are all stored on your secure CurrencyFair account.

Download our app from the App Store or Google Play

Working abroad

Remote working has become the new norm during 2020, and if you’ve opted to move abroad you can receive your overseas salary directly into your CurrencyFair account. When exchanging your salary into your preferred currency with CurrencyFair, you can benefit from lower-margin foreign exchange rates.

Check out our currency convertor to see how much you could save

Overseas taxes

Take the sting out of paying taxes by saving money when paying foreign tax in another currency, wherever you are in the world. Once you’ve filed your taxes, simply convert the amount owed using CurrencyFair, and send the money quickly and securely via CurrencyFair to the relevant tax authority.

If you’re due a tax refund, you can receive your refund through your CurrencyFair account. As there are no hefty fees or marked-up exchange rates, you’ll be left with more money in your pocket when exchanging your tax refund into your preferred currency.

Employee shares

You can receive the proceeds of selling international vested employee shares using CurrencyFair. Brokers and intermediaries selling your employee shares can charge additional fees to convert and transfer the currency received to your nominated bank account, but our competitive foreign exchange rates and flat-rate fee means more savings when exchanging money earned from the sale of vested shares in a foreign currency.

Studying abroad

If you or your child wishes to study abroad, you should consider ways you can save on tuition fees, textbooks, and everyday expenses such as rent and bills. Aside from the stress of organising a student visa, settling into your new country, and meeting academic deadlines, there is also a significant financial burden for international students.

Tuition fees can differ depending on your home country and which country you’re hoping to study in, but for example, if you wished to study in the UK and your home country is overseas, as an international student you can expect to pay between £10,000 and £26,000 annually for an undergraduate degree in 2020, according to Times Higher Education. Medical degrees are significantly more expensive for international undergraduate students and can cost up to £58,600 per year.

Comparatively, for students whose home country is England, English universities can only charge a maximum of £9,250 for undergraduate degrees. And this is just for the degree. For other costs such as accommodation, the average annual cost for students in the UK is £4,914 (based on a 39-week contract).

Education and the costs that go along with it can be steep, and if you’re converting currencies to pay for these costs it could end up being significantly more expensive. By using CurrencyFair, you can avoid hidden currency exchange fees and high international banking fees. Whether transferring money for student accommodation or to pay for textbooks and enrollment fees, CurrencyFair has you covered.

Our same-day transfers on major currencies will give mum and dad the peace of mind of knowing that if you find yourself in a financial pinch, they can quickly send you money for groceries, rent, and other necessities.

Buying overseas property

For life’s bigger steps such as signing for an overseas mortgage, CurrencyFair can save you money on your repayments. Often, you’ll have to also pay out for other costs such as valuation fees, hiring a moving company, and budget for any renovations you’d like to make.

Buying property is an expensive undertaking, but you can amass huge long-term savings by using CurrencyFair for your overseas mortgage repayments. For example, if your savings are in Euro and you’re paying off a mortgage in the UK at a cost of £2,500 per month, you will save €102.06 per month with CurrencyFair when compared with a typical bank (comparison carried out on 13 October 2020 at 12:26).

We’re up to eight times cheaper than the banks, meaning you can invest more money into making your new house a home.

Selling or renting overseas property

Similarly, if you’re selling an overseas property you can avoid hefty markups on foreign exchange rates with CurrencyFair. If you find a buyer, settle sales quickly and get same-day transfers on major currencies from over 150 countries.

Or, if you’re not ready to sell, rent your property and invoice your tenants in their local currency. They will know exactly how much to send you, and their payments will arrive as fast as a domestic transfer, without the hidden bank fees.

Overseas pension

For other regular transactions such as receiving your pension, you can avoid hidden currency exchange fees when receiving your overseas pension. Convert regular or lump sum pension payments into your choice of currency at bank-beating FX rates.

As we have local bank accounts across the globe, most international transfers on our platform are treated as domestic transfers, saving you time and money. Our quick transfers mean you can enjoy the peace of mind of knowing you’ll receive your pension on time, every time, wherever you are in the world.

Other ways to save on foreign exchange

Another way to save on your foreign exchange costs is to choose your own rate on our unique peer-to-peer marketplace. Our marketplace matches you with other customers who want to buy the currency you are selling at the rate you have chosen. Simply set your rate and wait for a peer-match. Our customers could even beat the FX rate available at that time in the currency markets, meaning more money in your pocket.

You can also sign up for a Rate Alert from CurrencyFair. Create a tailored alert based on your most traded currencies and never miss out on great rates again.

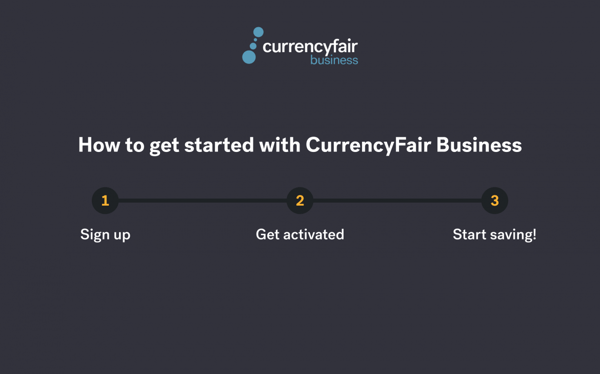

Have you got the CurrencyFair advantage? Access bank-beating FX rates, low-cost international transfers and first-class customer support.