CurrencyFair is an international currency exchange platform. It allows you to send and receive money to and from 150+ countries in over 20 currencies. Get same-day transfers on most major currencies from a trusted and secure source which is fully licensed and regulated.

For big life moments such as buying property overseas, to the ones that matter most like sending money to family abroad - CurrencyFair has you covered.

In this guide to opening a CurrencyFair personal account we look at how to get the most from your account. Watch step-by-step guides on:

• How to register for a CurrencyFair personal account

• How to top up your CurrencyFair account

• How to exchange currency in your CurrencyFair account

• How to exchange currency using the CurrencyFair marketplace

• How to send money from your CurrencyFair account

• How to transfer funds out of your CurrencyFair account

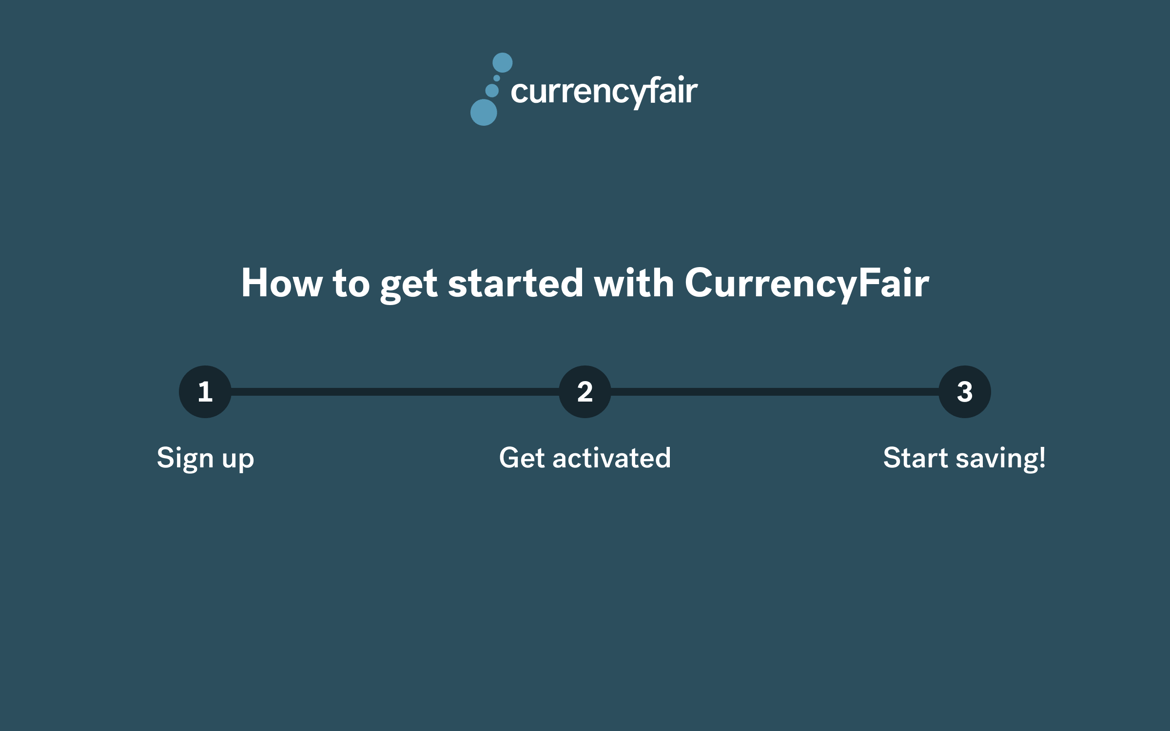

Let’s find out how to sign up and start saving money on international money transfers.

How to register for a CurrencyFair personal account

Sending money overseas is simple with a CurrencyFair personal account. Simply sign up and start saving on international money transfers and currency exchange with:

• Bank-beating exchange rates

• Fast transfers, often within 24 hours

• One account for multiple currencies

Watch how to register for a CurrencyFair personal account:

How to top up your CurrencyFair account

In this video we show you how to top up your CurrencyFair account so you can start using it to exchange currency and transfer money overseas.

Watch how to top up your CurrencyFair account:

How to exchange money in your CurrencyFair account

We have the only platform that lets you trade in two ways. You can exchange currencies immediately at bank-beating rates, or choose your own rate and wait for a match on our unique peer-to-peer marketplace.

Watch how to exchange money in your CurrencyFair account:

How to exchange funds using the marketplace with your CurrencyFair account

Here we go through the steps to choose your own exchange rate on our unique peer-to-peer marketplace. Ideal when your transfer is not urgent and you want to wait for an even better rate than the current live rates.

Watch how to exchange funds in the marketplace in your CurrencyFair account:

How to send money from your CurrencyFair account

Our user-friendly platform allows you to securely send money to over 150 countries. In the office, working from home or on the go, exchange on our platform from any device, at any time.

Watch how to send money from your CurrencyFair account:

How to transfer funds out of your CurrencyFair account

In this video we show you how to transfer money out of your CurrencyFair account and into your own, or another recipient’s bank account.

Watch how to transfer funds out of your CurrencyFair account:

Download our app for iOS devices or from the Google Play store.

Get the CurrencyFair advantage today. Access bank-beating FX rates, low-cost international transfers, and first-class customer support. Sign up now.

.jpg?width=600&name=guide_to_getting_started_with_a_currency_fair_personal_account%20(1).jpg)