International money transfers can be costly, with hidden fees and fluctuating exchange rates that impact how much you spend to send money abroad. Whether you're sending money abroad to a friend, paying a bill overseas, or making the leap to purchase a new property in a foreign country, it's worth researching your options to save money. Many online money transfer companies claim to offer attractive exchange rates, but once you break down the cost you may be spending more than you expect.

Money transfer companies operate by charging an additional margin to the interbank exchange rate, transfer fees or a combination of both. Typically, banks add a margin of between 3% and 6% on top of the interbank rate. CurrencyFair, on the other hand, charges an average margin of 0.45%. You can access great FX rates in Germany from any device, at any time, and send and receive international money transfers in over 20 currencies with a CurrencyFair account.

Some providers hide fees and charges in their exchange rate or make the information difficult to find on their websites. Others use complicated terms and conditions around their fees. Many of the money transfer providers we researched offer introductory rates and "fee-free"exchanges for first-time customers, then charge high fees for future transactions. For a more detailed look at sending money abroad, check out our guide: Sending money abroad: a guide to international money transfers.

Some providers hide fees and charges in their exchange rate or make the information difficult to find on their websites. Others use complicated terms and conditions around their fees. Many of the money transfer providers we researched offer introductory rates and "fee-free"exchanges for first-time customers, then charge high fees for future transactions. For a more detailed look at sending money abroad, check out our guide: Sending money abroad: a guide to international money transfers.

At CurrencyFair, our fee is always just €3.00 (or currency equivalent), regardless of the amount you're sending. We also empower our customers to choose their own exchange rates on our marketplace.

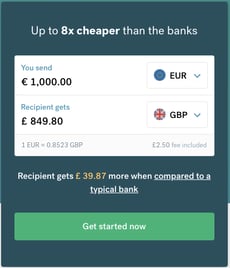

We've broken down the true cost of transferring money from Germany with money providers like Ace, Western Union, Small World, XE, Paypal and CurrencyFair by comparing how much it would cost to send and convert €1,000 from Germany to British pounds.

CurrencyFair's transparent fees and low margins will end up costing you less for transfers from Germany, as seen in our comparison assessment below. Read on to get into the details of each company compared.

| Money transfer company |

Amount sent |

Exchange rate and fees |

Delivery time |

Final amount received |

| CurrencyFair |

€1,000 |

1 EUR = 0.8523 GBP Fees: €3.00 or currency equivalent |

One day |

£849.80 |

| ACE Money Transfer |

€1,000 |

1 EUR = 0.8459 GBP Fees: First transfer is free, then £10 |

One - two days |

£845.90 |

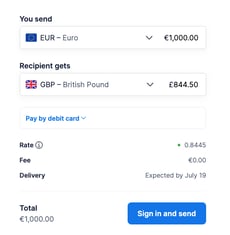

| XE 16:02, 16 July |

€1,000 |

1 EUR = 0.8445 GBP Fees not specified |

One day |

£844.50 |

| Western Union |

€1,000 |

1 EUR = 0.8335 GBP Fees: €2.90 |

One - three days |

£833.53 |

| PayPal 16:40, 16 July |

€1,000 |

1 EUR = 0.8255 GBP Fees: Not specified |

One day |

£825.47 |

| Small World 16:26, 16 July |

€1,000 |

1 EUR = 0.8248 GBP Fees: €30.50 |

Minutes |

£824.81 |

Money transfer companies in Germany compared:

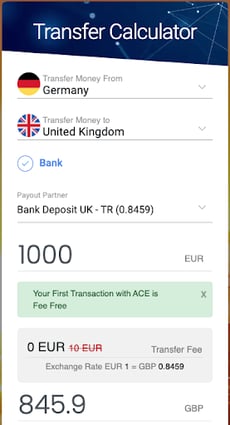

Using ACE Money Transfer for money transfers from Germany

Aftab Currency Exchange Limited, trading as ACE Money Transfer, provides remittance services from 23 countries to 106 countries worldwide, including Germany. You can pay for online transfers using ACE Money Transfer with a debit or credit card, or using an online bank transfer. It charges fees based on a percentage of the total amount you're sending.

It offered an exchange rate of 1 EUR = 0.8459 GBP (15:44, 16 July), with no fees for the first transfer. After your first transfer, the transfer fee goes up to 10% of your transaction cost. To transfer 1,000 EUR, the transfer fee would be 10 EUR. At CurrencyFair, our fee is always just €3.00 (or currency equivalent), regardless of the amount you're sending.

To transfer 1,000 EUR from Germany to British pounds using ACE Money Transfer, the recipient would get 845.90 GBP.

Exchange rate and fee accurate as of 15:44, 16 July 2021

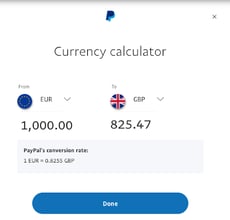

Using PayPal for money transfers from Germany

PayPal is a popular digital payment platform that offers money transfers and international payments. Despite its popularity, PayPal is one of the more expensive ways to transfer money abroad.

The PayPal fee structure calculates a currency conversion fee of up to 4% that is adjusted and retained by PayPal in their exchange rates. Then, there is a personal payment fee followed by a small fixed fee for the money transfer. The PayPal personal payment fee depends not only on the country of the recipient but also the country of the sender. Learn more with our guide: Avoiding PayPal's Currency Conversion Fees.

To transfer 1,000 EUR from Germany to British pounds it offered an exchange rate of 1 EUR = 0.8255 GBP (16:40, 16 July), meaning the recipient will receive 825.47 GBP.

Exchange rate and fee accurate as of 16:40, 16 July 2021

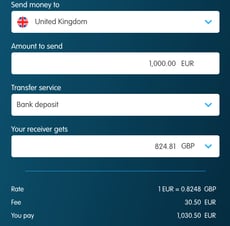

Using Small World for money transfers from Germany

Small World Financial Services provides online money transfers and in-person transfers from its worldwide agent network of 250,000 locations in 90 countries.

It offered an exchange rate of 1 EUR = 0.8248 GBP (16:26, 16 July), with a 30.50 EUR fee. To transfer 1,000 EUR from Germany to British pounds using a bank transfer, it adds the fee to the send cost. So for a total cost of 1,030.50 EUR, the recipient would get 824.81 GBP.

Exchange rate and fee accurate as of 16:26, 16 July 2021

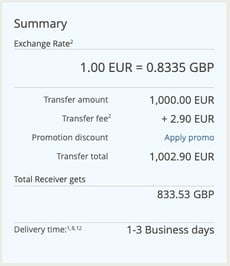

Using Western Union for money transfers from Germany

Western Union is one of the largest remittance companies in the world, with over 500,000 agent locations dotted across the globe. Its exchange rate changes depending on the delivery and payment method you choose.

To send 1,000 EUR from Germany to British pounds it offered an exchange rate of 1 EUR = 0.8335 GBP (16:49, 16 July). If you'd like to pay online by bank transfer and send it to the recipient's bank account, there is a €2.90 fee. So for 1,002.90 EUR, the recipient will get £833.53, with an estimated delivery time of one to three business days.

Exchange rate and fee accurate as of 16:49, 16 July 2021

Western Union doesn't accept business payments, and you are limited to sending 5,000 EUR per day. When paying for the bigger things in life, such as buying property overseas, paying for education abroad or transferring your savings, this can be at best inconvenient and at worst, unworkable. Breaking up a large transaction over several days is not only annoying, it can also end up a lot more expensive thanks to fees getting incurred every time. With CurrencyFair, you can send up to 97,000,000 EUR per transfer from Germany, and we offer tailored solutions for our business customers.

Why choose CurrencyFair for your business

Using XE for money transfers from Germany

XE is part of the Euronet Worldwide group and forms the third largest money transfer business in the world. To transfer 1,000 EUR to British pounds it offered 1 EUR = 0.8445 GBP (16:02, 16 July), so sending 1,000 EUR from Germany converts to 844.50 GBP.

Under its FAQs, it states that: "Your money will reach its destination quickly, securely, and with no hidden feesâ€. However, it also states that: "Some money transfers are subject to a small feeâ€, without specification as to what transfers are subject to them, and how much they might be. CurrencyFair's transparent fees are fixed at €3.00 or currency equivalent for transfers from Germany.

Exchange rate and fee accurate as of 16:02, 16 July 2021

Using CurrencyFair for money transfers from Germany

CurrencyFair was founded in 2009 and offers secure money transfers to over 150 countries and over 20 currencies. Our exchange rate of 1 EUR = 0.8523 GBP includes our €3 fee, meaning when you send 1,000 EUR to British pounds the recipient will get 849.80 GBP (15:39, 16 July).

Exchange rate and fee accurate as of 15:39, 16 July 2021

You can choose to send money immediately with our quick, low-cost money transfers, or set your own rate on our marketplace, and wait for the market to meet it — meaning you could even beat the currency market rate that you see on Google.

Join over 170,000 happy customers who have saved millions with CurrencyFair.

If you're sending money abroad from somewhere else in the world, compare the money transfer providers available in the following countries below:

- Money transfer companies compared: France

- Money transfer companies compared: Switzerland

- Money transfer companies compared: Thailand

- Money transfer companies compared: Australia

- Money transfer companies compared: India

- Money transfer companies compared: United Kingdom

For a more detailed look at sending money abroad, check out our guide: Sending money abroad: a guide to international money transfers.

Photo by Sebastian Herrmann on Unsplash

%20(1).jpg?width=600&name=tim-trad-BYPMtjYMEyk-unsplash%20(2)%20(1).jpg)