When sending money overseas, consumers and businesses want to know they are getting the best exchange rates, paying the lowest fees and most importantly, can be confident that their money will arrive safely.

After all, everyone’s reason to send money overseas is unique: maybe it’s to deposit savings, or to receive a monthly pension payment or just to send a gift to family. No matter the reason, one thing they all have in common is the importance of the transfer to them.

Spending time researching different providers of small and large money transfers to India means asking questions like:

-

-

Who is offering the best rate to exchange to Indian Rupee?

-

Who is offering the lowest fee to transfer money to India? Xoom, WorldRemit or CurrencyFair?

-

When will the transfer arrive in the bank account in India?

-

For this comparison, we took the rates available to exchange Euro and Pound Sterling to Indian Rupee with several popular providers to see who offered:

-

-

-

-

The best exchange rates

-

How fees were calculated

-

How long a transfer of INR takes?

-

-

-

WorldRemit

Gathered on 20 February 2020 17:10 GMT.

World Remit vs CurrencyFair

Exchange rates:

We compared the exchange of Euro and Pound Sterling with WorldRemit and CurrencyFair to Indian Rupee.

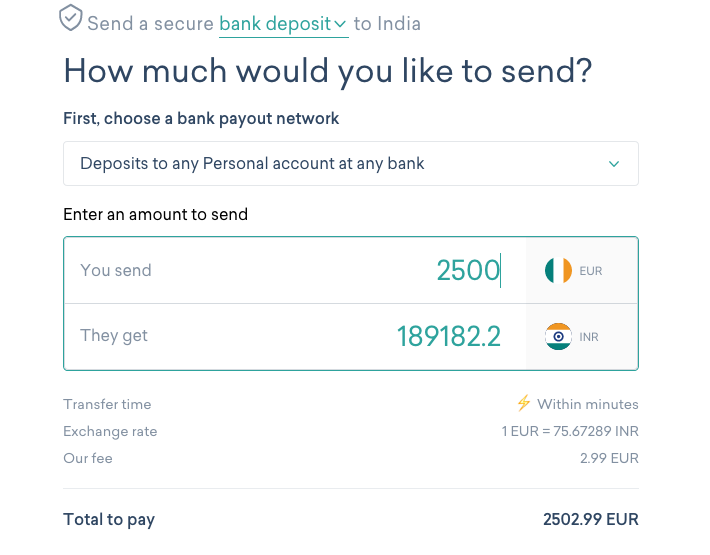

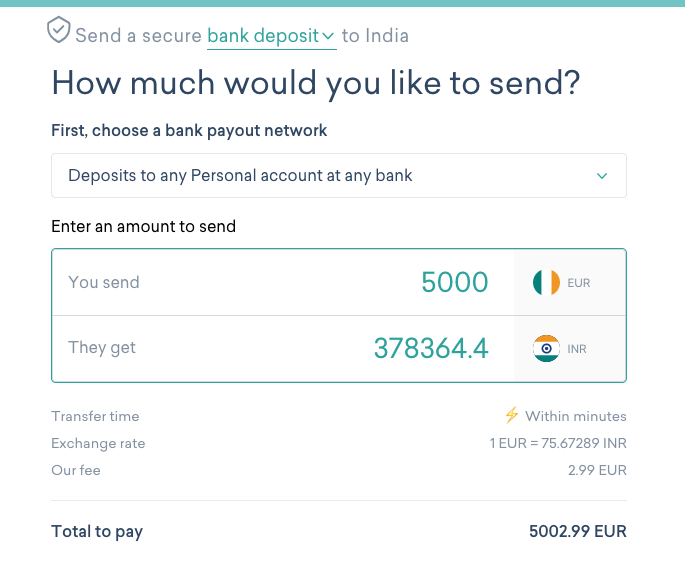

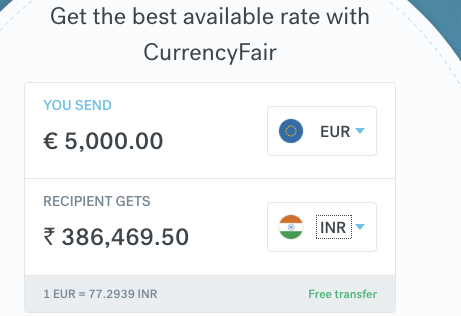

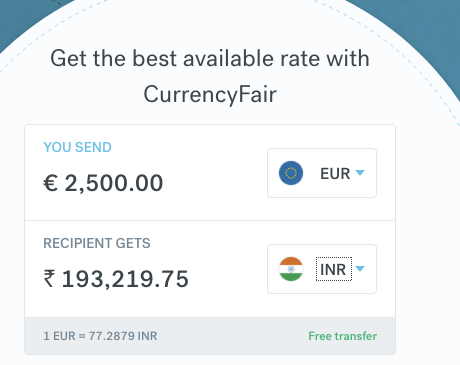

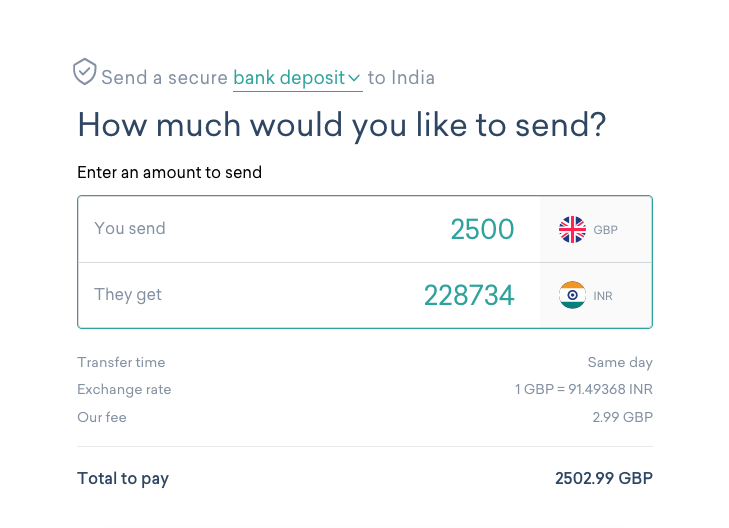

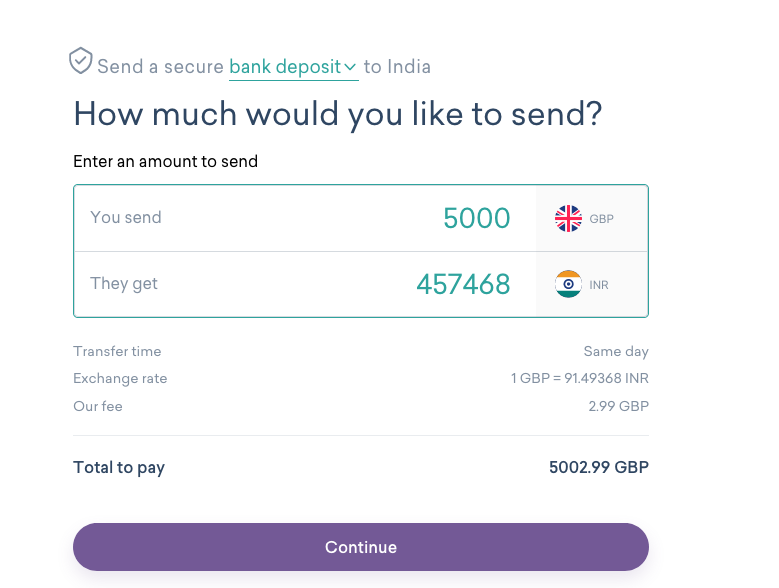

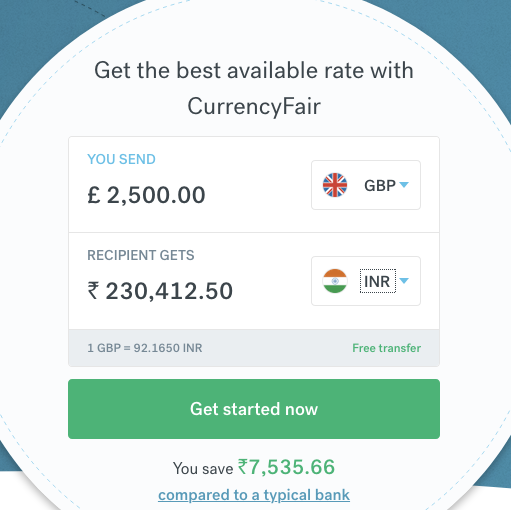

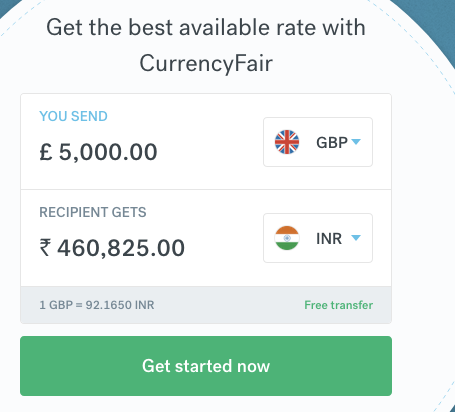

A comparison of different size money transfers of £2500, £5000, €2500 and €5 000 to INR with WorldRemit and CurrencyFair can be seen here:

| Comparison | Recipient gets with WorldRemit | Fees with WorldRemit | Recipient gets with CurrencyFair | Fees with CurrencyFair |

| £2 500 to INR | 228 734INR | £2.99 | 230 412.50INR | No fee* |

| £5 000 to INR | 457 468INR | £2.99 | 460 825INR | No fee* |

| €2 500 to INR | 189 182.20 INR | €2.99 | 193 291.75INR | No fee* |

| €5 000 to INR | 378 364.40 INR | €2.99 | 386 469.50INR | No fee* |

Fees with WorldRemit vs CurrencyFair:

With CurrencyFair right now and for a limited time only, we are offering free transfers of Indian Rupee.*

When sending money to India with WorldRemit, the fees for transfers are €2.99 or £2.99 depending on the currency being exchanged at the time of the comparison so sending £2500 plus the fee gives a total to pay of £2 502.99 and sending €2500, the total to pay is €2 502.99

Transfer time with WorldRemit vs CurrencyFair:

Transfer times with both providers depend on the transfer type. For bank transfers, World Remit can transfer INR within the same day and transfers of INR with CurrencyFair are the same day or up to one business day.

However the savings on money transfers with CurrencyFair is where we have a clear advantage.

Xoom

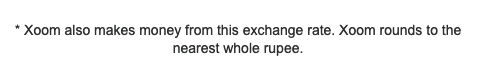

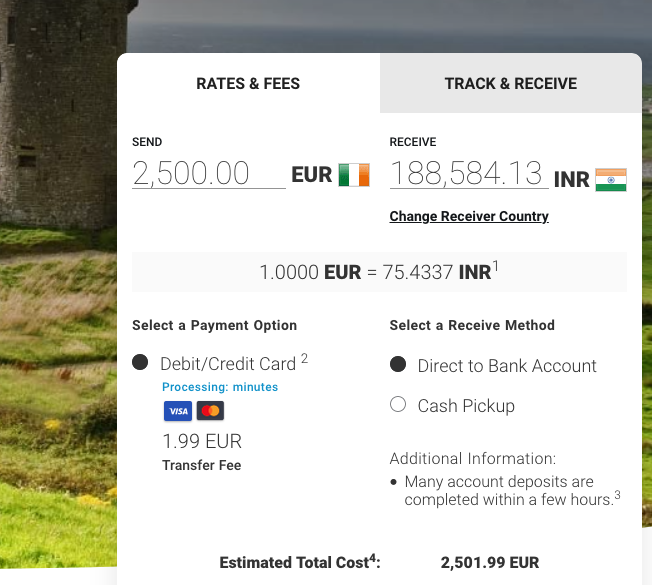

Gathered on 20 February 2020 17:10GMT.

Gathered on 20 February 2020 17:05GMT.

Xoom vs CurrencyFair

Xoom is one of the latest offerings from PayPal giving electronic funds transfers and remittances.

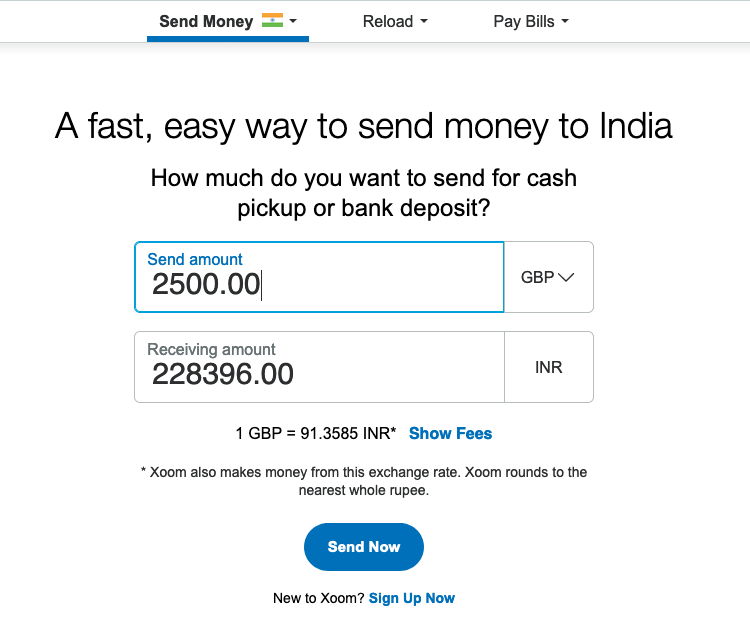

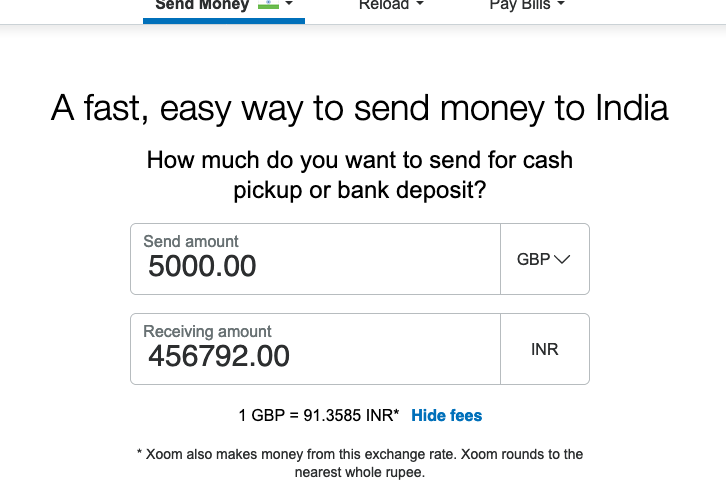

The global payments platform’s cost structure is made up of fixed fees that vary according to the destination country of the payment. The money sent with Xoom can be received via a cash pickup or deposited to a bank account.

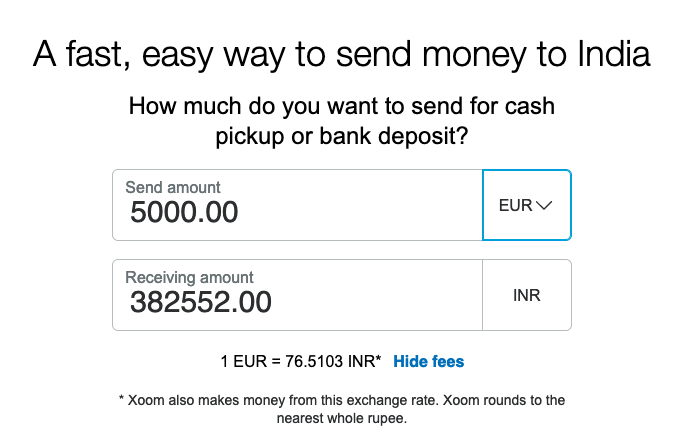

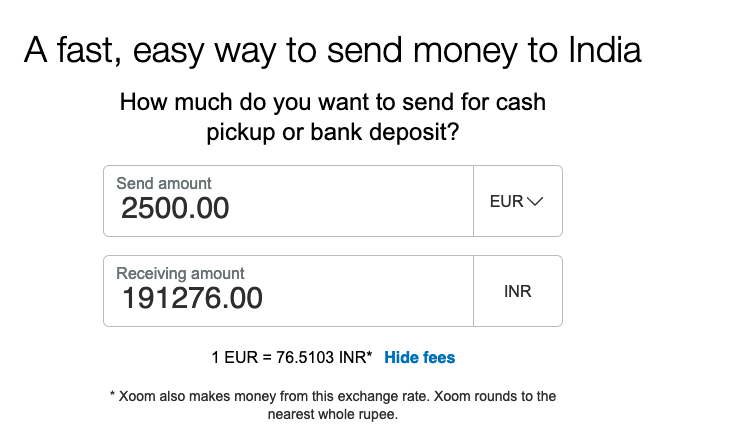

Xoom also state that they make money from the exchange rate:

Gathered on 20 February 2020 17:05GMT.

Exchange rates for Xoom vs CurrencyFair:

According to our comparison, as a result of this exchange rate, Xoom customers are losing out compared to CurrencyFair customers.

A comparison of different size money transfers of £2500, £5000, €2500 and €5 000 to INR with Xoom and CurrencyFair can be seen here:

| Comparison | Recipient gets with Xoom | Fees with Xoom | Recipient gets with CurrencyFair | Fees with CurrencyFair |

| £2 500 to INR | 228 396INR | No fee | 230 412.50INR | No fee* |

| £5 000 to INR | 456 792INR | No fee | 460 825INR | No fee* |

| €2 500 to INR | 191 276INR | No fee | 193 291.75INR | No fee* |

| €5 000 to INR | 382 552 INR | No fee | 386 469.50INR | No fee* |

Fees with Xoom vs CurrencyFair:

While it appears that Xoom don’t charge fees on their transfers, Xoom fees are instead bundled into the exchange rate, meaning Xoom customers get even less INR to send.

For CurrencyFair, we typically charge INR120 and for a limited time, INR transfers are free to a bank account in India.*

Transfer Times with Xoom vs CurrencyFair:

If using Xoom to send money abroad, customers can expect money to arrive in “minutes or days”. Xoom doesn’t offer a breakdown of transfer times on their page.

Transfer times of INR with CurrencyFair occur within the same day or up to one business day. However on the amount sent to the recipient, compared to Xoom, CurrencyFair comes out on top.

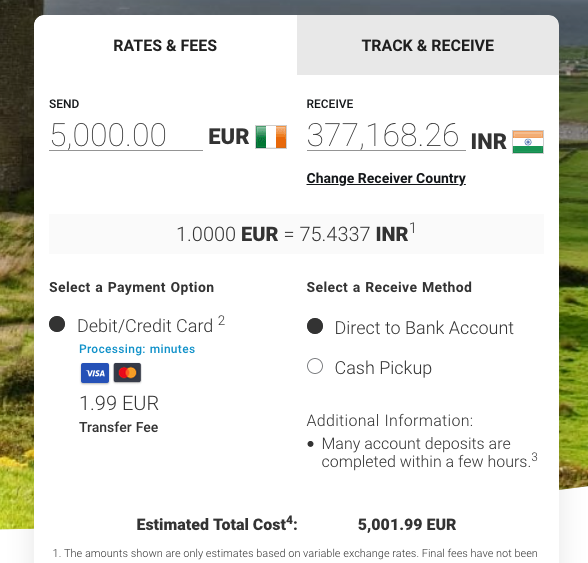

MoneyGram

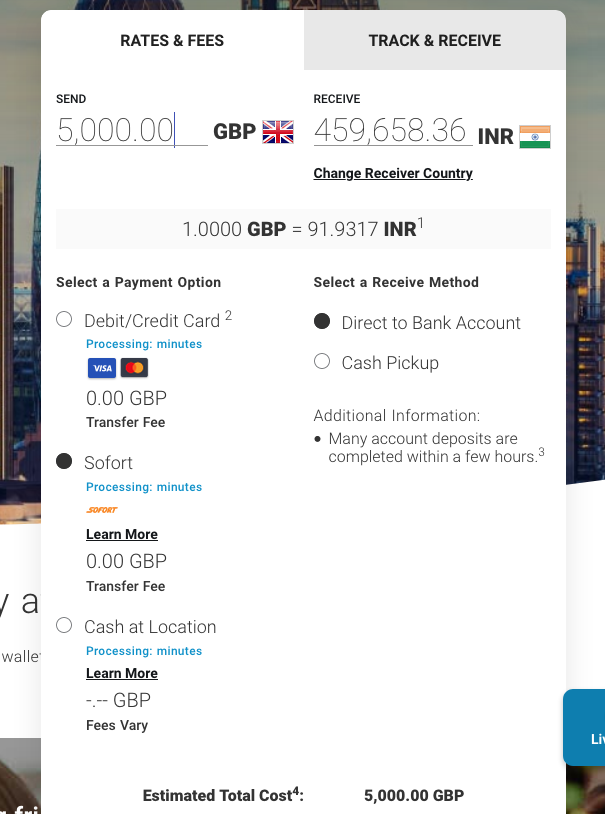

Gathered on 20 February 2020 17:10GMT.

Gathered on 20 February 2020 17:05GMT.

Exchange rates with MoneyGram vs CurrencyFair:

MoneyGram is an American international money transfer company who operates online and through a number of agents all over the world, including the UK Post Office and other retailers.

While they are easy-to-access and have many sending and receiving options, their pricing value-for-money in comparison to CurrencyFair really speaks for itself:

A comparison of different size money transfers of £2500, £5000, €2500 and €5 000 to INR with MoneyGram and CurrencyFair can be seen here:

| Comparison | Recipient gets with MoneyGram | Fees with MoneyGram | Recipient gets with CurrencyFair | Fees with CurrencyFair |

| £2 500 to INR | 229 829.18INR | No fee | 230 412.50INR | No fee* |

| £5 000 to INR | 459 658.36INR | No fee | 460 825INR | No fee* |

| €2 500 to INR | 188 584.13INR | €1.99 | 193 291.75INR | No fee* |

| €5 000 to INR | 377 168.26INR | €1.99 | 386 469.50INR | No fee* |

Fees with MoneyGram vs CurrencyFair:

For transferring Euro to India with MoneyGram, customers can only send money in with their debit card and incur a fee. To transfer Pound Sterling with MoneyGram, customers can choose to deposit money by debit card and incur a fee or by bank transfer, where no fee is charged.

With CurrencyFair, customers can choose to transfer in money by bank transfer at no extra costs or by Express Deposits in certain currencies.

Transfer times with MoneyGram vs CurrencyFair:

Choosing either to deposit by debit card or bank transfer with MoneyGram, the transfer is within minutes.

With CurrencyFair deposits by bank transfer occur on the same or within one business day. Express Deposits your money arrives even faster to be exchanged at the best available rates.

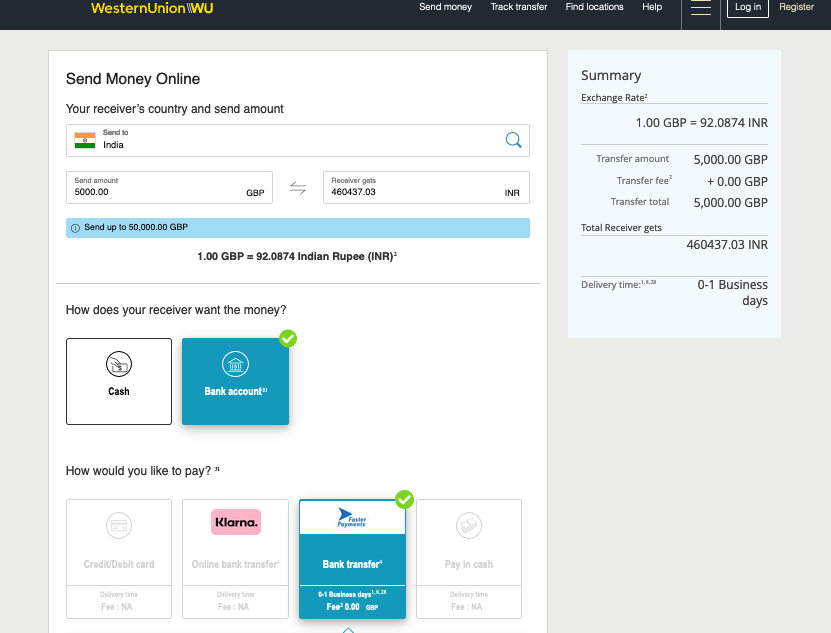

Western Union

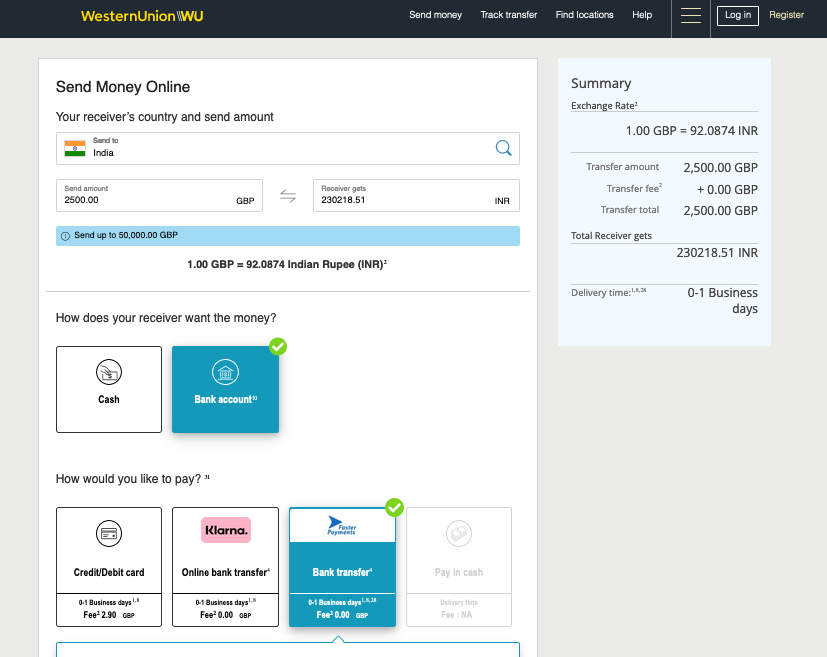

Gathered on 20 February 2020 17:10GMT.

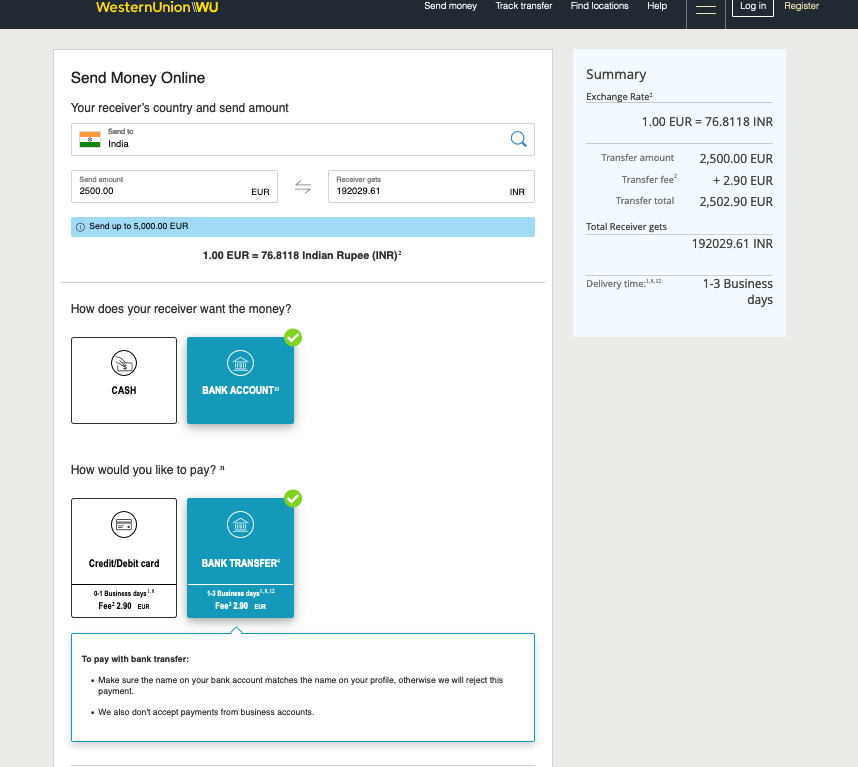

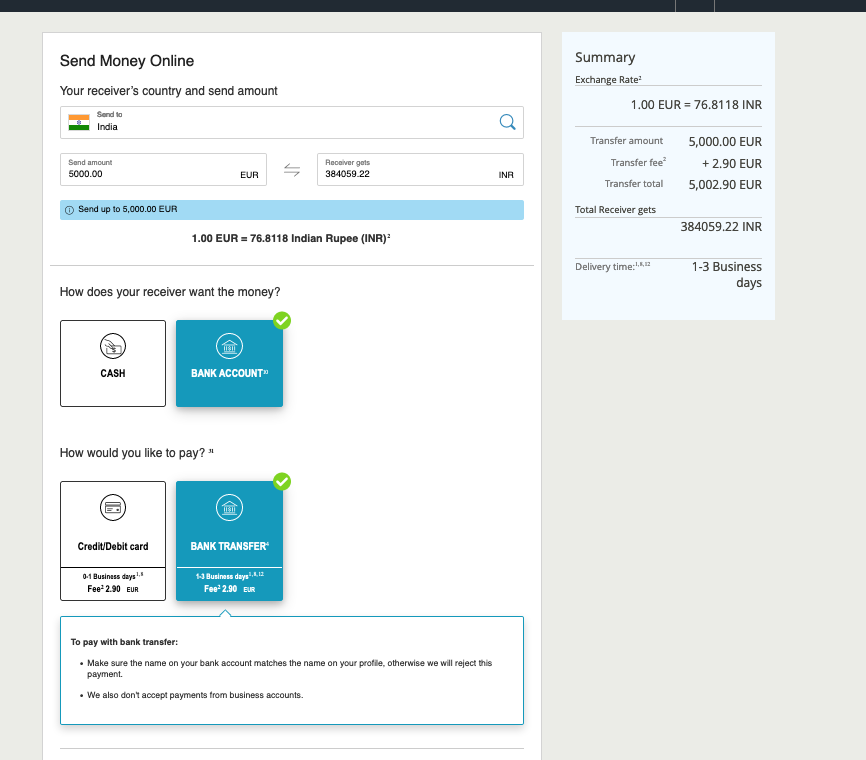

Gathered on 20 February 2020 17:05GMT.

Exchange Rates with Western Union vs CurrencyFair:

Western Union have been carrying out offline remittance services for decades.

Western Union states that the margin placed on the currency market rate is how they make profit, and that these are “subject to change without notice.”

CurrencyFair’s calculator accurately indicates the exchange rate to be used on a transfer, and is comparatively better value to Western Union.

A comparison of different size money transfers of £2500, £5000, €2500 and €5 000 to INR with Western Union and CurrencyFair can be seen here:

| Comparison | Recipient gets with Western Union | Fees with Western Union | Recipient gets with CurrencyFair | Fees with CurrencyFair |

| £2 500 to INR | 230 218.51 INR | £0 | 230 412.50INR | No fee* |

| £5 000 to INR | 460 437.03INR | £0 | 460 825INR | No fee* |

| €2 500 to INR | 192 029.61INR | €2.90 | 193 291.75INR | No fee* |

| €5 000 to INR | 384 059.22INR | €2.90 | 386 469.50INR | No fee* |

Fees with Western Union Vs CurrencyFair:

In this comparison, for a bank transfer of Euros to India with Western Union there is a €2.90 fee. A bank transfer of Pound Sterling to India with Western Union incurs no fee at the time of the comparison.

Gathered on 20 February 2020 17:05GMT.

Transfer Times with Western Union vs CurrencyFair:

In this comparison, a bank transfer of Euros to India with Western Union takes 1-3 business days and for Pound Sterling, your money arrives on either the same day or one business day.

Transfer times of INR with CurrencyFair occur within the same day or up to one business day.

There are many providers of money transfers to India, all offering different fees, rates and transfers times. In CurrencyFair we strive to be transparent and fair, therefore we always urge customers to review the alternative to the current service they use to see what savings they could make and to ensure they see the rates, fees and charges they could be charged upfront.

However with CurrencyFair, you can be certain your money is in safe hands.

A CurrencyFair account gives personal and business customers:

-

Exceptional rates that are cheaper than a typical bank, with no hidden fees.

-

The option to set a rate in our unique peer-to-peer marketplace.

-

World-class customer support, with an “Excellent” Trustpilot rating.

- As a financially regulated company, have peace of mind that your money is always secure.

*Terms and Conditions apply. Find out more here

%20(1).jpg?width=600&name=tim-trad-BYPMtjYMEyk-unsplash%20(2)%20(1).jpg)