If you need to send money abroad from the United States, it's worth reviewing your options to save time and money. We investigated some leading money transfer companies available in the US for anyone planning to send money internationally by comparing how much it would cost to send and convert 1,000 US dollars from the US to Europe into euros (EUR). Read on to get into the details of each of the money transfer companies we compared.

How much does it cost to send money abroad from the US?

Money transfer companies operate by charging an additional margin to the currency market exchange rate, transfer fees or a combination of both. For a more detailed look at sending money abroad and what impacts those costs, check out our guide: Sending money abroad: a guide to international money transfers.

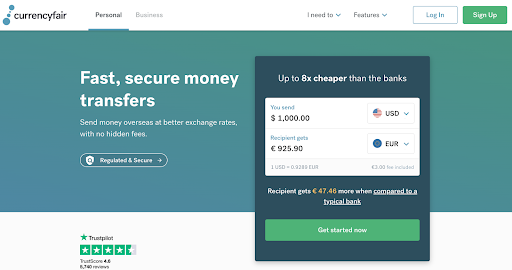

CurrencyFair is up to eight times cheaper than sending money abroad with a traditional money transfer provider, like a bank. You can access great exchange rates in the US from any device, at any time, and send and receive international money transfers in over 20 currencies with a CurrencyFair account.

Some providers hide fees in their exchange rate or make information on them difficult to find on their websites. Others use complicated terms and conditions around their fees. At CurrencyFair, our fee is always just $4 (or currency equivalent), regardless of the amount you're sending. To celebrate our recent launch in the US, new customers can get 10 fee-free transfers.

Money transfer companies in the US compared:

| Money transfer company | Exchange rate | Delivery time | Fees | Final amount received in exchange for 1,000 USD |

|

CurrencyFair |

1 USD = 0.9289 EUR |

One day |

$4/€3 |

€925.90 |

|

XE |

1 USD = 0.9219 EUR |

Four hours |

None specified |

€921.90 |

|

Wise |

1 USD = 0.9340 EUR |

One day |

$16.81 |

€918.30 |

|

Xoom |

1 USD = 0.9143 EUR |

Two and a half hours |

None specified |

€914.30 |

|

Western Union |

1 USD = 0.9101 EUR |

Half a day |

$0.99 |

€910.10 |

|

PayPal |

1 USD = 0.9034 EUR |

Three days |

$4.99 |

€903.36 |

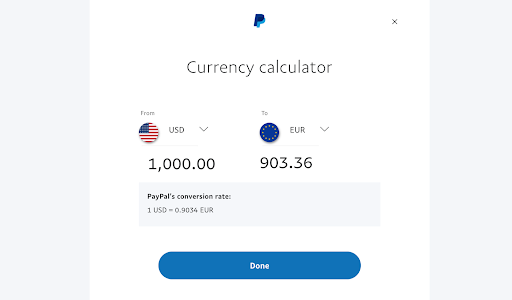

Using PayPal for international transfers from the US:

PayPal is a popular digital payment platform that offers money transfers and international payments. Despite its popularity, PayPal is one of the more expensive ways to transfer money abroad. If you want to send money abroad to someone who doesn't have a PayPal account, you'll be redirected to Xoom, a PayPal service for overseas transfers that we elaborate on below.

The PayPal fee structure calculates a currency conversion fee of up to 4% which is adjusted and retained by PayPal in its exchange rates. Then, there is a fee of up to $4.99 fee for international transactions from the US. Learn more with our guide: Avoiding PayPal's Currency Conversion Fees.

To transfer 1,000 USD from the US to euros it offered an exchange rate of 1 USD = 0.9034 EUR (15:49, 26 May), meaning the recipient will receive 903.36 EUR.

Exchange rate and fee accurate as of 15:49, 26 May 2022

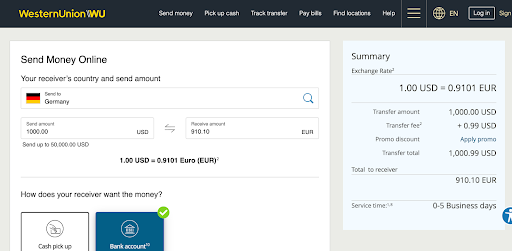

Using Western Union for international transfers from the US:

Western Union is one of the largest remittance companies in the world, with over 500,000 agent locations. Its exchange rate changes depending on the delivery and payment method you choose. Its fees vary depending on a range of factors, such as the destination country you're sending to, the way you pay for your transfer and the way you want your recipient to get the money.

To send 1,000 USD from the US to euros it offered an exchange rate of 1 USD = 0.9101 EUR (15:33, 26 May). The recipient will get 910.10 EUR, with the estimated delivery time being the same day as the transfer.

Western Union limits this transfer type to 50,000 USD per day. When paying for the bigger things in life, such as buying property overseas, paying for education abroad or transferring your savings, this can be at best inconvenient and at worst, unworkable.

Breaking up a large transaction over several days is not only annoying, but it can also end up a lot more expensive thanks to fees getting incurred every time.

Exchange rate and fee accurate as of 15:41, 26 May

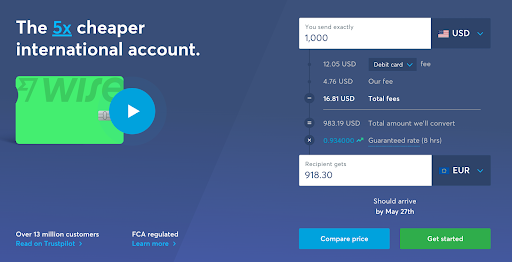

Using Wise for money transfers from the US

Wise is a money transfer provider headquartered in England. Depending on how quickly you need the funds to reach the recipient, you can opt for different tiers of transfer speed with different costs.

To send 1,000 USD from the US into euros using a debit card it offered an exchange rate of 1 USD = 0.9340 EUR (11:21, 23 March), with a 16.81 USD fee. So 983.19 USD gets exchanged into 918.30 EUR, and should arrive within one day.

Exchange rate and fee accurate as of 15:36, 26 May

However, its fees can snowball when you send larger amounts and can fluctuate depending on which currencies you're converting. Also, while you can use your debit or credit card to facilitate the transfer of smaller amounts, larger amounts have to be done via wire transfer. The table below demonstrates how these fees can add up, particularly if you're transferring a large amount. At CurrencyFair, our $4 (or currency equivalent) fee stays the same, whether you're transferring $100 or $1,000,000.

|

Amount sent with Wise |

Wise fees to send money using a debit card |

Wise fees to send money using a wire transfer |

|

1,000 USD |

16.81 USD |

8.93 USD |

|

10,000 USD |

Not available for this quantity |

47.47 USD |

|

100,000 USD |

Not available for this quantity |

432.81 USD |

Fees accurate as of 16:12, 26 May 2022

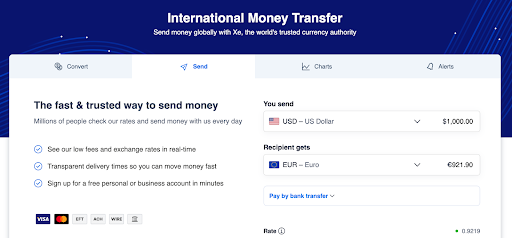

Using XE for money transfers from the US

XE is part of the Euronet Worldwide group and forms the third-largest money transfer business in the world. It offered an exchange rate of 1 USD = 0.9219 EUR (15:38, 26 May). So for 1,000 USD, your recipient will get 921.90 EUR with a delivery time of within one day.

Under its FAQs, it states that: “Your money will reach its destination quickly, securely, and with no hidden fees”. However, it also states that: “Some money transfers are subject to a small fee”, without specifying what transfers are subject to them, and how much they might be.

CurrencyFair's transparent fees are fixed at $4 (or currency equivalent) for transfers from the US.

Exchange rate and fee accurate as of 15:38, 26 May 2022

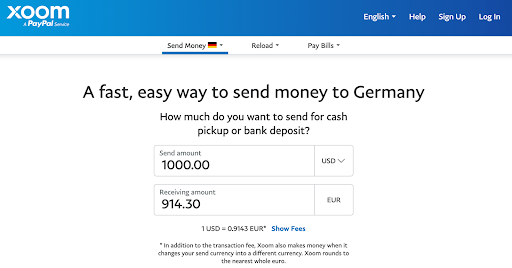

Using Xoom for money transfers from the US

Xoom Corporation was founded in 2001 and acquired by PayPal in 2015. It has its headquarters in San Francisco, California, and operates globally in 160 countries, including the US. Xoom is a PayPal service that allows you to send money to a recipient's bank account, debit card or mobile wallet, even if they don't have a PayPal account.

To transfer 1,000 USD to euros using Xoom it offered an exchange rate of 1 USD = 0.9143 EUR (15:40, 26 May). At this rate, your recipient would receive 914.30 EUR. As well as its mark up to the mid-market exchange rate, Xoom's fees vary depending on your transaction type and amount, the payment method and what currency you pay with, the amount of the transaction and which country it's going to.

Exchange rate and fee accurate as of 15:40, 26 May 2022

Using CurrencyFair for money transfers from the US

CurrencyFair was founded in 2009 and offers secure money transfers to over 150 countries and over 20 currencies, including the US. Our exchange rate of 1 USD = 0.9289 EUR (15:33, 26 May) includes our €3/$4 (or currency equivalent) fee, meaning when you send 1,000 USD to euros, the recipient will get 925.90 EUR.

Exchange rate and fee accurate as of 15:33, 26 May 2022

CurrencyFair does not provide domestic transfers within the US. However, you can send money internationally from the US at rates up to eight times cheaper than a traditional bank, with no hidden fees. Whether you need to remit the sale of shares, buy overseas property or pay overseas tax, save money on your currency exchange. Join over 170,000 happy customers who have saved millions with CurrencyFair. If you're sending money abroad from somewhere else in the world, compare the money transfer providers available in the following countries:

If you're sending money abroad from somewhere else in the world, compare the money transfer providers available in the following countries:

This information is correct as of 23 March 2022. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. Photo by Miltiadis Fragkidis on Unsplash.

%20(1).jpg?width=600&name=tim-trad-BYPMtjYMEyk-unsplash%20(2)%20(1).jpg)