As international travel opens up and becomes the norm again, the appeal of buying a property abroad also returns. Whether hoping to relocate permanently, looking for a home away from home, or just seeking to diversify their investment portfolio with a tangible asset, nearly 40% of Singaporeans surveyed in 2020 were planning to buy real estate abroad in the coming years, with Malaysia and Australia among the most sought-after markets. And with interest rates predicted to remain low for the foreseeable future, and global housing prices expected to continue to rise, now may be a good time to research your options.

As with any large purchase, it's best to approach this decision with as much information at your disposal as possible. With that in mind, we've prepared this quick guide to the most important considerations for Singaporeans intending to buy property overseas.

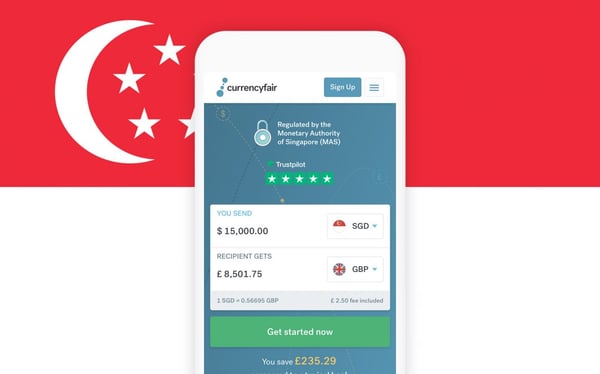

Avoid hefty markups on exchange rates when buying or renting out overseas real estate with CurrencyFair. Our lower-margin FX rates offer bigger savings on overseas money transfers, and our world-class customer service will take care of you when you need it.

Considerations for HDB owners

If you purchased a subsidised home from Singapore's Housing & Development Board (HDB), you are prohibited from buying residential property overseas until after you have fulfilled the minimum occupation period on that premises (typically five years). After that time, if an HDB flat owner buys another home abroad, they will need to sell their flat within six months of the purchase, making sure the sale complies with the HDB's Ethnic Integration Policy and the Singapore Permanent Resident quota for their neighbourhood or block.

(Note: The rules above apply to residential property only. HDB owners are free to invest in commercial property overseas before the minimum occupancy period on their flat has been fulfilled.)

Can you use your CPF to pay for overseas property?

Unfortunately, funds accumulated through Singapore's Central Provident Fund (CPF) savings and pension scheme cannot be put towards the purchase of any property outside of the country's borders. Also bear in mind that if you need to take out a loan to facilitate the purchase of your overseas property, any money borrowed from a Singaporean bank will be subject to the nation's Total Debt Servicing Ratio, which stipulates that borrowers are only permitted to spend a maximum of 60% of their gross monthly income on debt repayments.

On the positive side, by buying abroad, Singaporean citizens and permanent residents avoid the prohibitive Additional Buyer's Stamp Duties that apply to the purchase of second and subsequent properties within Singapore. (Currently 12% for citizens buying a first additional property and 15% for any further premises, while permanent residents pay 5% for a first additional property and 15% thereafter.) Taking this plus Singapore's steep property prices into account, buying overseas remains an appealing option. But before taking the plunge, it's important to fully review the rules on foreign property ownership in whichever country you're interested in. Below are some of the most significant regulations placed on overseas buyers in some of the most popular markets.

Rules for buying property in Malaysia for Singaporeans

Just across the Causeway but boasting significantly lower property prices and cost of living, Malaysia is an obvious first choice for Singaporeans seeking an additional home. Though its restrictions on foreign property buyers are relatively lenient, there are certain issues to be aware of. For example, in the federal territories of Kuala Lumpur, Putrajaya and Labuan, the minimum house price for foreign buyers is currently RM 600,000 (S$194,104*). Other states set their own thresholds, varying from RM400,000 to RM2 million (S$129,403 to S$647,015*). It should also be noted that under Malaysian law, certain types of land are off-limits to foreigners, such as Malay reserved land, land reserved for Bumiputeras, and agricultural land not intended for commercial use.

Once you find a suitable property, you'll need to apply for state authority consent before your sale can go through. This process generally takes one to three months, and is subject to a fee and/or levy on the property purchase price, depending on the state. Stamp duty of between 1-4% will also apply. These costs may potentially be offset by applying for the Malaysia My Second Home programme – a government scheme that allows foreigners who fit specific criteria to stay in the country on a 10-year renewable visa, and to avail of discounts on certain kinds of properties. Though temporarily suspended due to the pandemic, the programme is expected to resume whenever feasible.

Rules for buying property in Australia for Singaporeans

One of the most consistent real estate markets in the world, nearby Australia is another attractive locale for Singaporeas eager to buy. However, its government has placed tight restrictions on foreigner buyers, preventing them from purchasing any established dwellings. Non-residents may only buy new or pre-constructed residential developments, and are required to apply to the Foreign Investment Review Board for approval prior to making a purchase. This typically takes up to 30 days, and an application fee tied to the property price applies. As of January 2021, fees for residential land start at AU$6,350 (S$6,542*) for acquisitions of AU$1 million (S$1,030,344)* or less.

Singaporeans thinking of buying in Australia should also be aware that stamp duty surcharges of up to 8% apply for foreign purchasers in certain regions, and that absentee owners are required to pay additional land taxes in states including Queensland, Victoria and New South Wales.

Rules for buying property in the United Kingdom for Singaporeans

There are no limitations on the types of property foreign investors can buy in the UK, nor is it necessary to apply for any specific kind of approval.

It should be noted however that the UK government recently introduced a Stamp Duty Land Tax (SDLT) surcharge of 2% for overseas buyers of residential property, on top of the 3% surcharge which already exists for anyone purchasing a second home in England or Northern Ireland. (The surcharges do not apply in Scotland or Wales, which have different taxation systems for land and buildings.) The UK's temporary SDLT “holiday” on the first £500,000 (S$922,295*) will expire in the coming months, returning to the old rates of between 2-12% on any property priced above £125,000 (S$230,573*). This all means that with the new surcharge, as of April 2021, any foreign buyer purchasing a second home within the highest value band will end up paying 17% in SDLT.

So whether you're pulled towards the sunny climes of Australia, the cultural and historical draw of the UK, or the diverse attractions of Malaysia, purchasing an overseas property remains an appealing prospect for Singaporeans. With the right preparation, investing in a home abroad can bring rewards for years to come.

How CurrencyFair can help you save money on your overseas property purchase

In making these kinds of large payments across borders and currencies, huge amounts can be lost to hidden fees. At up to eight times cheaper than a typical bank, CurrencyFair's safe, reliable service will save you money, leaving you with more cash to spend on furnishing your new overseas property.

*Exchange rate correct as at 27/04/2020

Disclaimer: This article is for general information purposes only and does not take into account your personal circumstances. This is not investment advice or an inducement to trade. The information shared is for illustrative purposes only and may not reflect current prices or offers from CurrencyFair. Clients are solely responsible for determining whether trading or a particular transaction is suitable. We recommend you seek independent financial advice and ensure you fully understand the risks involved before trading. Leveraged trading is high risk and not suitable for all. Losses can exceed investments. Opinions are the authors; not necessarily that of CurrencyFair or any of its affiliates, subsidiaries, officers or directors.

Photo by Tierra Mallorca on Unsplash

Sources:

https://www.propertyguru.com.sg/property-guides/propertyguru-consumer-sentiment-study-h2-2020-29486

https://www.researchandmarkets.com/reports/5238001

https://www.hdb.gov.sg/residential/selling-a-flat/eligibility

https://www.pwc.com.au/tax/assets/stamp-duty/australian-stamp-duty-and-land-tax-maps.pdf

https://www.gov.uk/stamp-duty-land-tax/residential-property-rates

.jpg?width=600&name=Blog%20post%20size%20(1).jpg)