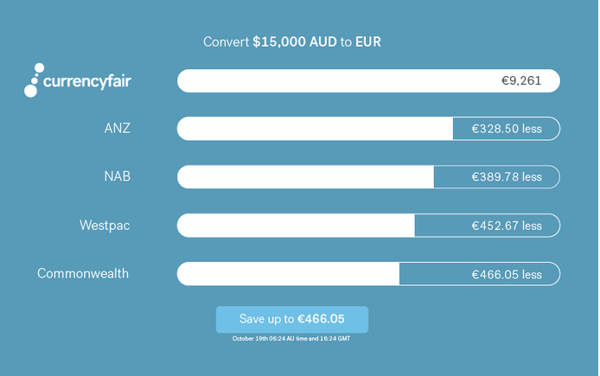

For big life moments such as buying property overseas, to the ones that matter most, like sending money to family abroad - CurrencyFair has you covered. When it comes to making international payments the exchange rate can make a significant difference to the overall cost. Changes and fluctuations to the rate can leave customers unsure of how much they will receive or how much they need to pay. Making it very difficult to predict the final cost of a transaction.

To lessen this challenge CurrencyFair is now offering our customers a fixed exchange rate for a period of 48 hours. This means that the exchange rate at the time of the transaction is locked in for 48 hours and will not change within that time. So you know exactly how much to send and how much will be received.

The fixed rates feature is now available on desktop as well as on our iOS and Android app. Please ensure you have the most up-to-date version of our app to access fixed rates.

What does this mean?

It means that you can choose whether to turn this fixed rate on or to leave it off, in which case your transaction’s exchange rate will reflect the rate at the moment in time that it is exchanged. If your transfer is actioned outside of the 48 hour window it will also reflect the exchange rate at the time of transfer. However, customers can rest assured that we will only process the transaction if the exchange rate is within 3% of your original rate. If the rate drops by more than 3% we’ll cancel the transaction and send you an email to let you know. Your funds will be immediately made available for you to instruct a new exchange and transfer out from your CurrencyFair profile.

Why are we introducing this feature?

At CurrencyFair we want to give our customers the peace of mind that when it comes to exchanging currency, they are getting the best value for their money. We want to ensure that every euro, dollar, or peso goes further for our customers.

We also understand that exchange rate fluctuations can add an element of uncertainty to international transactions, which can understandably be an obstacle and drawback to making these transactions. By offering you a secured, fixed rate we want to remove this barrier and ensure that we are creating a comfortable environment for our customers in what can sometimes be a volatile currency market.

Does the fixed rate period include the weekend?

We know that banks typically don’t process payments at weekends so we do not include Saturdays and Sundays in the fixed rate period. This means that if you create a Send Money transaction on Friday any time before the currency markets close (20:00 Dublin time), your rate will be fixed until that time the following Tuesday. This is to allow time for the banks to send your funds to us for exchange and transfer.

What are the advantages of fixed rates?

The most important and significant advantage is the peace of mind it brings to your transaction. A fixed rate gives you certainty that you are getting the rate that you want for your chosen currency pair. So when you’re buying a house overseas, sending money to your loved ones, transferring your pension, paying tuition fees, or whatever other thing you need to exchange funds for, you don’t have to worry that you’ll end up with a different sum in the end.

By locking in your exchange rate within the specified 48h period, you can eliminate the stress and uncertainty that comes with exchange rate fluctuations. This fixed rate is extremely helpful and can even save you considerable amounts when you are exchanging large amounts. We’re allowing our customers to plan ahead with certainty that they are getting their money’s worth.

The fine print

- When you select the fixed rate option during your Send Money transaction, we will fix the exchange rate for 48 hours. This means that you will get this rate if we receive your funds within this 48 hour period, so it’s important for you to send your money in to us as quickly as you can.

- In the unlikely event that the rate changes by 3% or more during the fixed rate period, we may cancel your Send Money transaction. If your Send Money transaction is cancelled, you will be notified by email and your funds will be immediately made available for you to instruct a new exchange and transfer out from your CurrencyFair profile.

- If your funds are not received or cleared to CurrencyFair within the 48 hour period, we will exchange and transfer your money using the best available rate at the time when your funds are cleared.

- If your funds arrive after the fixed period expires, rest assured, we will only process the transaction if the exchange rate is within 3% of your original rate. If the rate drops by more than 3% we’ll cancel the transaction and send you an email to let you know. Your funds will be immediately made available for you to instruct a new exchange and transfer out from your CurrencyFair profile.

- As CurrencyFair cannot hold funds, if your exchange is cancelled, these funds must be immediately exchanged and transferred out.

- Fixed rates do not apply to MXN, VND or KRW.

- Please ensure you have the newest version of CurrencyFair's mobile apps in order to access this feature.

This information is correct as of 13 December 2023. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. CurrencyFair Ltd is regulated by the Central Bank of Ireland.

.jpeg?width=1170&name=GettyImages-623427218%20(1).jpeg)