The stock market is notoriously volatile, and putting your savings in shares carries significant risk. But when done well it can be a profitable long-term investment strategy. Australians know this better than most: According to the ASX Australian Investor Study 2020, nearly half the adult Australian population currently holds investments other than their primary residence, and more than half of those own direct shares in publicly traded companies. Part of the reason for the popularity of investing in shares is a low barrier to entry – buying and selling equity on the Australian Securities Exchange (ASX) is relatively straightforward even for a novice, by creating an account with either an online or full-service broker. This blog gives an overview of these two main methods of buying shares in Australia and explores the advantages and disadvantages of each approach.

How investing in shares works

Anyone who buys shares in a publicly-traded company becomes a part-owner of that company. Your stock value then rises and falls relative to supply and demand, dictated by both the current financial performance of the business in question, and the market's perception of its anticipated future performance. Investors typically aim to predict these fluctuations to sell their shares for profit.

Of course, like any investment, buying shares carries risk. Market perceptions can be flawed, stocks can be overvalued, and share prices can drop suddenly based on market cycles, legislative changes and various other factors which are sometimes difficult to predict. If this happens, your shares may end up being worth less than you paid for them. If the company you've invested in fails completely, you could potentially lose your entire investment.

On the positive side, as well as having the option of selling shares for profit where possible, shareholders in some companies earn an income on shares, receiving a portion of the business's annual earnings in the form of a dividend, generally paid out twice a year. Ordinary shareholders are also usually entitled to vote at general meetings on issues such as the appointment or removal of company directors. Public companies are legally obliged to hold these meetings at least once a year.

How to buy shares

The Australian Securities Exchange (ASX) is tightly regulated. To begin buying or selling shares, investors must sign up with a licensed third-party broker who will conduct transactions on the ASX on their behalf. It's easy to create an account with either a full-service broker or an online trading platform, but choosing which method will suit you best depends on a number of considerations.

When you begin trading, the advice offered by the ASX is to start with a minimum of AU$2,000. With almost all brokers there is a minimum order size of AU$500 for your first purchase of shares in any ASX listed company. In placing an order with your broker, you can choose to buy shares at market price as soon as possible, or you can set a limit price, stipulating the amount you are willing to pay for a certain share. The settlement period for Australian sharemarket trades is two days, meaning payment must be made on the second business day after any purchase. Once a trade has been executed, your broker will supply you with a Confirmation Contract Note.

Anyone skittish about making their first trade without experience can dip their toe in the water risk-free by registering to play the sharemarket game on the ASX website, where players are invited to invest AU$50,000 virtual cash and watch how well their hypothetical investment portfolio performs. If you're eager to create a real brokerage account immediately, read on to learn more about your options.

How to buy shares with a full-service broker in Australia

There are currently more than 2,000 companies listed on the ASX*, and knowing where to start as a beginner share investor is daunting. As well as conducting market transactions on behalf of clients, traditional, full-service stockbrokers will offer research, analysis and informed advice, providing recommendations of shares that are most likely to provide the kind of returns the investor is hoping to achieve.

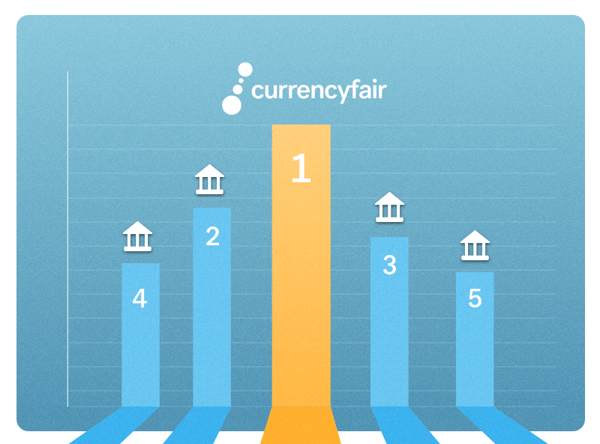

Guidance like this from an experienced professional is an obvious benefit to anyone with little understanding of the market. As a result, going this route is more expensive than using an online trading platform – full-service brokers generally charge either a flat fee or a percentage of the transaction amount for every trade, beginning from around AU$50. If that price sounds worth the peace of mind it may buy you, the ASX has a list of Australian full-service brokers on its website.

How to buy shares online in Australia

Registering with an online broker is the cheaper option. Though you won't receive advice on what trades to make, most online trading platforms offer a certain amount of market research which you can use to make an informed selection. You can also use resources available on the ASX website to educate yourself before beginning to trade – they offer a free online shares course complete with quizzes to test your knowledge.

It's free to create an account with most online brokers, and there are plenty to choose from. However, fees and commission structures can vary widely – anywhere from AU$0 to around AU$30 per trade. Some platforms also charge account management and inactivity fees. Other factors to consider include whether or not you want to invest in international markets, and how actively you plan to trade (brokerage fees vary according to the number of trades per month on many platforms).

To invest in international shares, you'll need to select a broker that offers access to the market or markets you want while the ASX has a list of more than 270 international companies available to invest in.

Conclusion

Whether your aim is to create a new income stream or build up a nest egg for the future, buying shares is an accessible investment strategy that could help you to meet your financial goals. All you'll need is a little capital, a thorough understanding of the risks involved, and the right broker to get you started.

Selling your shares overseas? Save money on international money transfers with CurrencyFair.

Photo by Austin Distel on Unsplash

https://www2.asx.com.au/blog/australian-investor-study

https://findadviser.asx.com.au/home

https://www2.asx.com.au/investors/start-investing/find-a-broker-adviser

Disclaimer: This article is for general information purposes only and does not take into account your personal circumstances. This is not investment advice or an inducement to trade. The information shared is for illustrative purposes only and may not reflect current prices or offers from CurrencyFair. Clients are solely responsible for determining whether trading or a particular transaction is suitable. We recommend you seek independent financial advice and ensure you fully understand the risks involved before trading. Leveraged trading is high risk and not suitable for all. Losses can exceed investments. Opinions are the authors; not necessarily that of CurrencyFair or any of its affiliates, subsidiaries, officers or directors.