Many retirees imagine spending their golden years in a beautiful destination that’s easy on their pocket. Thailand is often a popular choice for retirees. Not only is it a beautiful country with a cheaper cost of living but is also boasts an efficient healthcare system and vibrant culture–a winning combination that makes Thailand a pensioner’s paradise. This guide covers important details for retirees who are planning to retire in Thailand – from the Thai retirement visa to the country’s affordable cost of living.

Life in Thailand

It is important to weigh the pros and cons of retiring in Thailand before moving on to the logistics of the move itself. The country is brimming with culture and natural beauty. Whether choosing between the colourful, bustling cities or serene, white sandy beaches, the ‘Land of the Smiles’ leaves little to be desired.

Thailand’s climate is incredibly hot and humid, which can provide relief to anyone who suffers from arthritis. While some expats may welcome being able to get out doors to enjoy more swimming and sunshine, others may be hindered by the heat and find getting around in the higher humidity and temperatures.

So, what types of activities are there to enjoy in this beautiful country? Retirees in Thailand can take up leisure activities such as fishing, diving or sailing and just get out and explore the array of ancient sites and cultural activities on their doorstep. Plus, Thailand has a large and friendly expat community, meaning expats never feel too far from home.

The Cost to Retire in Thailand

Thailand is a popular destination among retirees due to its winning combination of fine weather, wonderful culture and of course, its very low cost of living. To put Thailand’s modest cost of living into perspective, travel blogger Shannon O’Donnell stated that her monthly expenditure in Thailand averaged a third of her U.S. monthly living expenses in the USA.

The area a retiree chooses to settle in can also impact their budget and cost of living. For example, the cost to retire in Bangkok is higher than the cost to retire in other regions like Pattaya, Phuket and Chiang Mai. Numbeo’s statistics on the cost of living plus rent provides clear evidence of this:

Similarly, the retiree’s chosen lifestyle will play into their cost of retiring in Thailand. Those happy to embrace a traditional Thai lifestyle will have lower day-to-day expenses than those who are not so enthusiastic about sacrificing traditional western comforts, like a more spacious apartment and less street food dining. The average Thai resident can live on approximately US$1,000 month-on-month, while those living a more luxurious retiree lifestyle may spend up to US$5,000 in the same time period.

Healthcare in Thailand

Anyone planning to retire in Thailand may be interested to know that Thailand boasts some of the best medical care in Southeast Asia. Travel resource site Expat Arrivals recommends utilising the very moderately priced private healthcare system to avoid queues and ensure the very best care. Expat Arrivals also recommend taking out in-patient insurance cover as a minimum, as out-patient treatments are quite affordable. The site additionally offers a helpful comparison of common international health insurance packages available here.

Thailand’s tropical climate means the country is home to tropical diseases and dangerous insects. Those planning to make the move should make sure their vaccinations are in check, use repellent, and cover up where possible to reduce the likelihood of needing a visit to a Thai hospital for emergency treatment.

How to Retire in Thailand

Before deciding to retire in Thailand, it is important to research the application process for a Thai retirement visa. Retirees over 50 years of age can choose between a one-year or five-year Thai retirement visa. Both visas are renewable, and their requirements are explored in further detail below:

One-year Thai retirement visa

To avail of Thailand’s one-year retirement visa, the applicant must meet any one of the following financial requirements:

-

A deposit of 800,000 THB lodged in a Thai bank account for a minimum of 2 months prior to application

-

A monthly income of 2,000 THB

-

A combination of the above to total 800,000 THB in one year.

On application, these means must be proven by providing supporting documentation, which could include an updated bank book, a bank statement showing a salary, or a letter from the relevant embassy in Thailand which alternatively verifies a monthly income. They may also require police clearance or a medical certificate.

This visa can be applied for inside Thailand, or with a Thai embassy or consulate in a home country.

Five-year Thai retirement visa

After spending over a year there, a retiree in Thailand may wish to then apply for a longer visa. The visa is only available to applicants from a limited list of countries and requires a lot more savings in order to be approved. Retirees looking for a five-year Thai retirement visa will need to make a commitment of three million THB to a Thai bank account for at least a year before applying. Applicants may also need to present proof of health insurance, clearance from the police and a medical certificate. This visa can only be applied for within Thailand.

Things to Keep in Mind

Thai retirement visa holders are required to report to the Immigration Office every 90 days to report their current residential address. This can be done by mail or in-person. Keeping records and setting up reminders for this requirement – as well as for visa renewals – could save retirees some unnecessary additional stress.

There are plenty of beautiful destinations surrounding Thailand that are ideal to visit and explore, but those planning to do so will need to keep their visa in mind when planning trips. When a retirement visa holder plans to make a trip outside of Thailand, they will need to apply for a re-entry permit. The retirement visa does not automatically entitle them to re-enter the country after travelling externally.

Is Retiring in Thailand worth it?

Those looking to enjoy their golden years in an exciting new country complete with beautiful scenery and sunshine won’t be disappointed with Thailand. Although the distinctive culture and extreme climate may take some adjusting to, those willing to take the plunge will likely enjoy what Thailand has to offer, with the added perk of being able to make their retirement savings go that bit further.

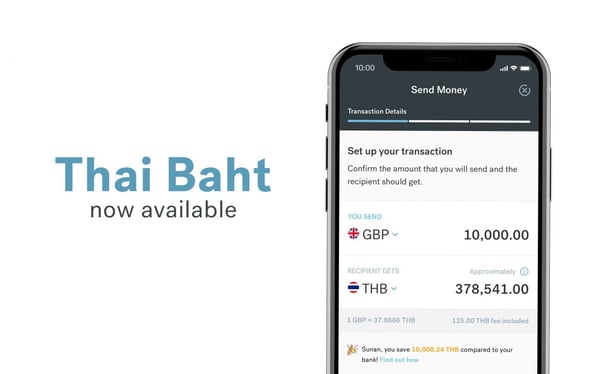

When moving savings to Thailand, CurrencyFair offers the support, speed and great exchange rates needed for transfers of Thai Baht. Banks hide their fees in poor exchange rates, often charging as much as 3%-6% in excessive margins. CurrencyFair is around 0.45% away from the currency market rate, meaning bank-beating exchange rates when sending money to Thailand.

The information contained in this article should not be relied upon as a substitute for professional advice in individual cases. Future changes in legislation, tax level, and practice could affect the information in this site. The information shown is based on date or information obtained from sources believed to be reliable but CurrencyFair makes no representation and accepts no responsibility as to its accuracy or completeness and will not be held liable for damages arising out of any person’s reliance upon this information.