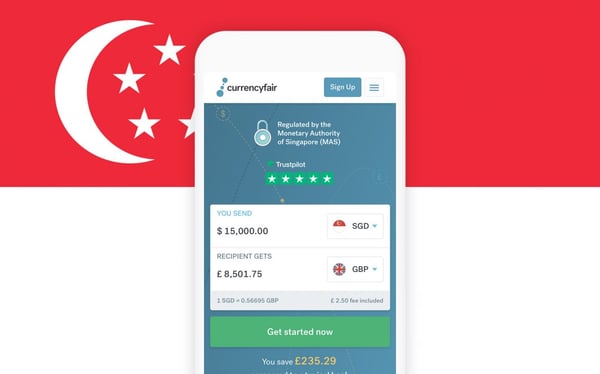

An Easier Way to Manage Money Transfers

CurrencyFair users residing in the UK can now hold balances in their profiles through our Partnership Program with Moorwand Ltd (FCA Reference No 900709), an e-money institution regulated by the FCA. This allows users more flexibility and control over their international money transfers. Say goodbye to the hassle of managing multiple external bank accounts for every transaction—this functionality allows you to store, convert, and send numerous currencies all in one place. This makes transfers quicker, more cost-effective, and easier to manage.

Why Hold Balances in your CurrencyFair profile?

Managing international payments from the UK can be costly and time-consuming. Holding balances in your account helps by allowing you to:

- Hold balances – Keep funds in GBP, EUR, and USD, and exchange them when exchange rates are favourable.

- Make faster transfers – Send money instantly without bank processing delays.

- Reduce costs – Avoid hidden bank fees and intermediary charges.

- Gain transparency – See real-time exchange rates and make informed decisions.

- Enjoy security – Funds are protected with encryption, secure login, and strict safeguarding regulatory requirements.

NB for UK Users: You can hold GBP, EUR, and USD balances, but they cannot be directly exchanged to INR due to licensing restrictions. To transfer funds to INR using the 'Send Money' option, deposit them into your CurrencyFair profile directly from an external source (e.g., your bank) and then exchange them to INR for transfer.

Who Benefits Most from Holding Balances?

Frequent International Money Senders

If you regularly send money abroad from the UK, holding balances helps you avoid the repetitive hassle of transferring funds for each transaction and bank delays. Whether you support family abroad or manage expenses across multiple countries, maintaining funds in various currencies makes transfers simpler.

Businesses and SMEs

For UK businesses making cross-border payments, holding balances removes delays and extra banking costs. Companies can make faster payments to suppliers, freelancers, and remote employees while benefiting from better exchange rates.

Expats and Remote Workers

Living and working abroad often requires managing multiple currencies. With this functionality, you can receive payments in one currency and convert them when rates suit you, helping you maximise your money.

Investors and Overseas Property Buyers

Planning to buy overseas property or manage investments abroad? Holding funds in multiple currencies allows you to exchange and send money when rates are favourable, helping you avoid unnecessary conversion fees.

How to Use Your Balances

Getting started with holding balances on your CurrencyFair profile is quick and simple for UK customers:

- Sign in to your CurrencyFair profile (or sign up now and save).

- Navigate to the Balances section of your profile.

- Top up your profile’s account by transferring money from your UK bank account.

- Hold or exchange and send funds whenever you need to.

Please note that UK customers can hold balances in EUR, GBP, and USD, but for other currencies, you will need to transfer out immediately after exchanging

Sample of CurrencyFair Balances

By managing multiple currencies in a single location, you can gain greater control of your international transactions and optimise your transfers by using real-time exchange rates.

Key Features: Top-Up Option and Quick Trade

Top Up Option

CurrencyFair now offers a convenient 'Top Up' option, allowing you to easily add funds to your balance. This feature enables you to maintain balances in GBP, USD, and EUR for UK customers, ready for future transactions or to take advantage of favourable exchange rates.

Quick Trade (Instant Exchange)

With Quick Trade, users with a balance in their account can access instant currency exchange. This allows for immediate conversions between currencies at competitive rates without waiting for peer-to-peer matches or market fluctuations.

Why Choose CurrencyFair?

CurrencyFair offers competitive exchange rates and low-cost international transfers. The ability to hold balances takes this further by cutting banking fees and giving you full control over your money. Unlike traditional banks that charge high fees for every international transfer, CurrencyFair lets you exchange currencies at competitive rates and send funds efficiently.

Start Managing Your Balances Today

Holding balances on your CurrencyFair profile is a smarter way for UK customers to manage international transactions. This makes sending money abroad, paying for overseas services, or handling business expenses smoother and more cost-effective. Take control of your currency exchange today!