If you're resident in Singapore and looking to invest in a new property, then perhaps you're considering opportunities outside of the city-state. Private residential property in Singapore is expensive, and the introduction of new, high taxes on second homes makes real estate investment even less appealing. You're likely to face many difficulties purchasing a second property at home in Singapore.

Planning on buying property overseas? Avoid hefty markups on exchange rates when buying and selling overseas real estate with CurrencyFair's low-margin FX rates.

Why Singaporeans are rushing to buy property in Australia

Many Singaporean residents are therefore choosing to invest in housing outside of the island state, rather than in Singapore itself. In fact, nearly 40% of Singaporeans surveyed in 2020 were planning to buy real estate abroad in the coming years. And in terms of location, Australia is enticing for investors for a number of reasons. From a financial perspective, the country has a stable housing market, as well as an AAA credit rating. Many of Australia's major cities have thriving rental markets, due to a shortage of housing. And from a geographical perspective, the country is within a short flying distance from Singapore.

Australia has a pleasant seasonal climate, breathtaking natural landscape, and an abundance of both livable cities and open space. The population also speaks English. And some say that there's never been a better time for foreign investors to settle in Australia after the federal government recently prioritised visas for wealthy applicants. In fact, Singapore is now the second-largest buyer of Australian real estate, just behind the United States.

But before considering a purchase you should arm yourself with as much information as possible, not least of all the rules foreigners face when buying a property there.

Rules for foreigners buying property in Australia

As of October 2021

One of the most significant restrictions you may face is that the Australian government has limited the types of housing that foreign investors can buy. They have implemented these limitations to make sure that foreign investments contribute positively to the country's economy and housing stock. Property types that Singaporean residents (or any foreign investor) can purchase are limited to:

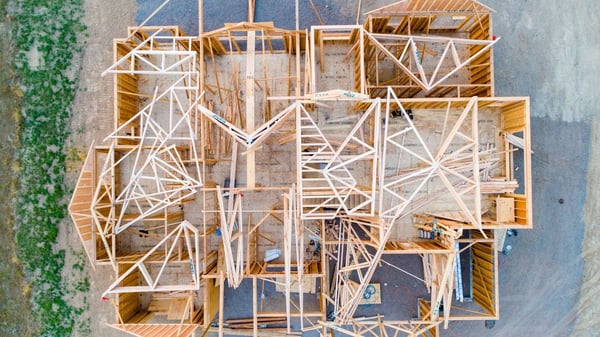

New buildings, or those under construction

Foreigners aren't allowed to take part in the Australian housing resale market. That means that you must be the first owner of your property, and so you're restricted to investing in new homes, whether already built or under construction.

Housing built on vacant land

Another option for foreign property investors is to purchase land that hasn't previously been used for housing. You're then free to construct a home on this land, but you must build your property within four years.

Established dwellings that you intend to demolish and expand

The only way in which foreigners can take part in the resale housing market is to knock down a home in order to build more homes on the same land. For example, you could demolish one large house and build three smaller properties in its place.

Note that these restrictions only apply to foreign investors who aren't Australian residents. If you live in Australia, even temporarily, then you can buy an established home to live in. However, when you leave the country, you must sell the property.

Applications that foreign investors must complete

Once you've found a suitable property to buy, you may sign a contract with the vendor or developer, but you must then get approval from the Foreign Investment Review Board (FIRB). The FIRB is responsible for ensuring that foreign investments are beneficial to Australia's economy. It's crucial to make sure that there's a clause in your contract stating that the agreement is subject to FIRB approval. Otherwise, if your FIRB application is denied, you may be liable to purchase the property without the legal right to do so.

You'll need to pay a FIRB application fee. The exact amount is determined by the value of the property you're buying, but expect it to be at least a four-figure sum. At the time of writing in October 2021, there's a maximum fee cap of AU$500,000. Also, you should bear in mind that the approval process can take up to one month. You may then need to complete a "foreign investment"application form for the Australian Tax Office (ATO).

Once you've passed all the necessary checks, you can go ahead with your purchase.

Fees and financing

Beyond the hefty application fees detailed above, you should also build in budget for the following:

Property deposit

Of course, deposits are not unique to Australian properties. Typically, housing deposits in Australia are around 20% of the property price. However, it's possible to secure a home for a lower deposit if you shop around.

Bear in mind that if you're financing the property using Singapore dollar (SGD), then you should plan carefully to minimise bank transfer costs. Banks typically charge five times more for every money transfer than CurrencyFair, and fluctuating rates on a large deposit sum could make a huge dent in your budget.

Legal and agent fees

If you're new to the Australian housing market, then you may wish to hire an agent to help you find a suitable property and handle the purchase negotiation. If you're buying to let, then an agent may also assist in finding local tenants. Hiring professionals on the ground is generally a good idea, though it may prove expensive.

Registration fees and stamp duty

You may also need to budget for mortgage registration fees and stamp duty - the cost of these will vary depending on in which state your property is located. And you may be required to pay an additional land tax if you're not going to be living in the new home. This also varies from state to state.

Restrictions for HDB owners

Finally, there's also no escaping the plethora of restrictions for Housing and Development Board (HDB) flat owners in Singapore, some of which apply to second homes purchased overseas. If you already have an HDB property in Singapore, then you must fulfil your Minimum Occupation Period (MOP - usually 5 years) before signing a contract for a second home abroad. And if you acquire a property abroad, and don't already have an HDB flat in Singapore, then you'll lose your eligibility to buy one.

Verify before you diversify

With interest rates low, it's a great time to build your portfolio by purchasing a second home overseas. Whether you're looking for an investment asset or a buy-to-let property to top up your monthly income, it's easy to see why Australia is a major investment destination for Singaporeans. However, you should research all the options available to you, before taking the plunge. We pulled together a guide to buying overseas property for Singaporeans, covering Malaysia and the UK, as well as Australia. And if you do settle for Australia, make sure to check for fees and restrictions, as well as the relevant state's property rules, before signing on the dotted line.

Planning on buying property overseas? Avoid hefty markups on exchange rates when buying and selling overseas real estate with CurrencyFair's low-margin FX rates.

Photo by Belle Co from Pexels

Photo by Belle Co from Pexels

This information is correct as of 19 October 2021. The information is not to be relied on in making a decision with regard to an investment. The article is purely for general information purposes.

%20(1).jpg?width=600&name=sebastian-herrmann-KvAzgHvM_-A-unsplash%20(1)%20(1).jpg)