Whenever you're sending money to India from overseas, or transferring funds between two banks in India, you'll be given a unique transaction reference (UTR) number. This is an essential reference if you need to track a transfer that is delayed, or confirm details of a transfer to the recipient. The UTR is generated by the bank that initiates the transfer, so you don't have to do much. And if you're sending money through CurrencyFair, you don't have to do anything at all. However, it's useful to know what a UTR looks like, where to find it, and when you might need it.

Sending money to India

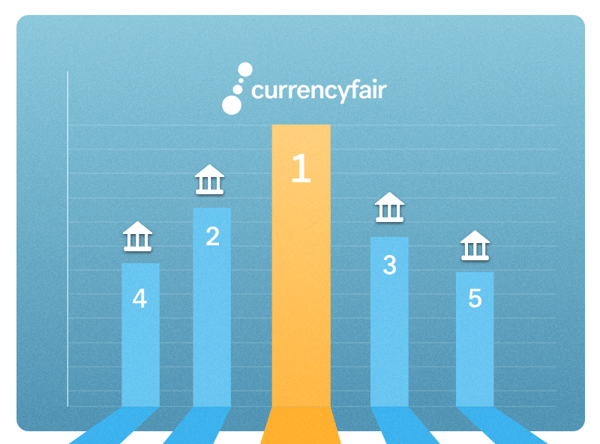

If you're sending money to India, you can take advantage of bank-beating exchange rates and fixed, transparent fees when you use CurrencyFair. We support transfers from more than 20 international currencies into Indian Rupees, and in most cases your money will arrive in just a few days.

What is a UTR number?

The UTR is a 16- or 22-character alphanumeric code for tracking transfers within the Indian banking system. The format is standardised by the Reserve Bank of India (RBI), and the length will depend on which of the two major networks your bank chooses for sending funds.

At this point, your attention may already be wandering, so there's really only one essential takeaway to seize before we dive deeper into the intricacies of alphanumeric coding:

* When you send money to India with CurrencyFair, we take care of the UTR tracking if there are any issues and delays. All you need to keep safe is the CurrencyFair ID generated when you make the transfer.

If you're making a transfer independently, however (as in bank to bank), you will be given the UTR. It doesn't contain any sensitive account information, so you can even stick it on a post-it note somewhere visible.

Not to be confused with…

The UTR is not the same as a bank account number or IBAN (the international version of your account number). Even if UTR numbers do start with a 4-character bank code, the UTR identifies a transaction, not an account.

The UTR is similar in function to a SWIFT code, but whereas SWIFT codes are for sending money internationally from an overseas bank account, a UTR is for transfers within the Indian banking system.

You may be thinking, “So why do I need a UTR if it's for bank transfers within India only?†The answer is that most money transfer services will inevitably use the domestic Indian banking networks towards the tail end of a transfer. As a result, the sender and recipient will require the UTR to track the progress of funds into the target account.

How to get a UTR number

The bank facilitating the transfer will generate the UTR. You don't have to move a muscle. Banks will choose one of two domestic networks, depending on the size and required speed of the transfer. There is no maximum transfer limit for either network, however.

National Electronic Funds Transfer (NEFT) is a centralised payment system operated by the Reserve Bank of India. Transfers are processed in batches (every half an hour) during working hours. If you're making an NEFT transfer, your UTR will be 16 characters long. The bank will typically send you and the recipient an SMS or email with confirmation that the funds are on their way.

Real Time Gross Settlement (RTGS) transfers are processed immediately, reaching your recipient in a matter of hours. The only restriction is that the transfer amount must be over Rs. 200,000 (approximately GBP £2,000). For a RTGS transfer, your UTR will be 22 characters long.

Where to find your UTR number

On your bank statement or mobile banking app, you will see the UTR in the transaction details.

You'll also see the UTR number on any transfer that uses either the NEFT or RTGS network, so it could appear on bill payments or online purchases.

How to crack the codes

The first four characters of either format will be the IFSC (Indian Financial System Code) for the sender bank. You'll also need this IFSC when sending money to India from overseas.

For an RTGS transfer, your UTR will follow this format:

4 character IFSC code | R (indicates RTGS) | single digit indicating the channel (i.e. ATM, internet, RTGS) | date of transaction as YYYYMMDD | 8-digit sequence number

Eg;

PUNBR92023030800438964

Punjab National Bank

RTGS network

RTGS channel

Sent 8th March 2023

Unique sequence

For an NEFT transfer, your 14-digit UTR will follow this format:

4 character IFSC code | single letter/digit that indicates NEFT network | year (2 digits) | Julian date of transfer (3 digits) | transaction reference number (6 digits)

Eg.

PUNBH23067004389

Punjab National Bank

NEFT Network

Sent 8th March 2023

Unique sequence

Tracking a transfer with a UTR

Supposing you've made a transfer to India, or between two banks in India, and the funds haven't arrived in your recipient's account within the expected time. There are two things you can do:

-

-

Consult your bank's mobile app. Your recent transactions should be listed on your statement (although they may marked as ‘pending') and you'll be able to see the current status of the transaction that matches your UTR.

-

Try your bank's customer service, quoting the 16- or 22-character UTR for fast retrieval of your transaction details.

-

When you choose CurrencyFair to make your international transfer, you won't have to personally track the funds using a UTR. All tracking starts and ends with your CurrencyFair ID, so the most important things to consider are:

-

-

Remembering to quote your CurrencyFair ID when making a transfer.

-

Checking you've entered the correct SWIFT code and IBAN number for your recipient.

-

Sending money to India

If you're sending money to India, you can take advantage of bank-beating exchange rates and fixed, transparent fees when you use CurrencyFair. We support transfers from more than 20 international currencies into Indian Rupees, and in most cases your money will arrive in just a few days.

This information is correct as of March 2023. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. Photo by rupixen.com