The Problem: Currency Exchange Rates on Tuition Fees Are Too Expensive

As an international student, you’re investing in your education and future, but paying overly expensive currency exchange rates for your tuition transfers doesn’t have to drain your wallet. Many students face unnecessary high fees, unfavourable exchange rates, and hidden costs when transferring money internationally. But there is a better way to save money and take control of your finances.

Your Solution: CurrencyFair

CurrencyFair is here to simplify your tuition payment process and help you save on currency transfers. With low fees, bank-beating exchange rates, and a secure platform, we make paying tuition fees easy, affordable, and stress-free.

A Simple Plan to Save Money on Tuition Payments

1. Understand the Challenges

Traditional payment methods like bank transfers and credit/debit cards often come with:

-

Hidden charges that inflate costs.

-

Poor exchange rates that reduce the amount received by your university.

-

Complicated processes that add unnecessary stress.

2. Follow These Steps to Save:

-

Calculate Your Costs: Understand the full amount you’ll pay, including tuition fees, conversion costs, and any extra charges.

-

Choose a Better Option: Opt for CurrencyFair, a service designed to save you money.

-

Monitor Exchange Rates: Plan your transfer when rates are most favourable.

-

Avoid Double Conversion Fees: Transfer funds directly to avoid unnecessary conversions.

-

Sign Up for CurrencyFair: Enjoy a streamlined process and start saving immediately.

Why Choose CurrencyFair?

With CurrencyFair, you gain access to:

-

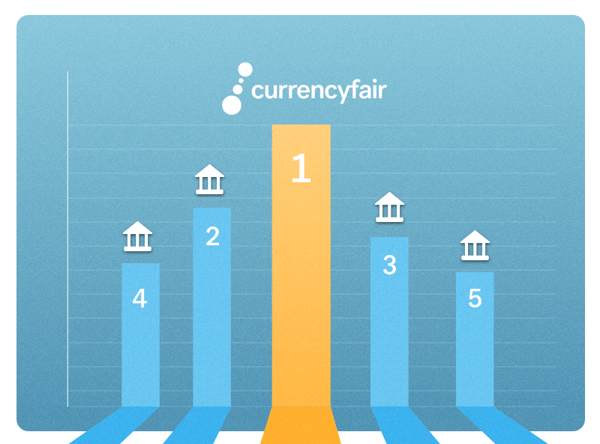

Better Exchange Rates: Save more compared to traditional banks.

-

Low Fees: Pay just a fraction of what you’d spend with other providers.

-

Complete Transparency: No hidden costs, only clear pricing.

-

Secure Transfers: Send funds safely and confidently from bank account to bank account.

Pay international tuition fees easily and cost-effectively with CurrencyFair.

Example: Real Savings with CurrencyFair

Sarah, an international student from Canada, needed to pay €10,000 for her studies in Europe. Her local bank quoted her an exchange rate with a 3% markup and a €25 transfer fee. By switching to CurrencyFair, Sarah:

-

Secured a rate with just a 0.5% margin.

-

Paid a flat €3 transfer fee.

This choice saved her over €300 on a single transaction! Over the course of her studies, the savings added up, letting her focus on her education instead of her finances.

What to Do Next

Don’t let high transaction fees and poor exchange rates eat into your education budget. Here’s how you can start saving today:

-

Sign Up for CurrencyFair: Sign up now and create your account.

-

Compare Your Costs: See the difference CurrencyFair’s rates and fees can make.

-

Make Smarter Payments: Transfer funds directly to your university and enjoy significant savings.

Sample exchange rate taken on Jan 8th, 2025

Takeaways You Can Use

-

Stop overpaying with traditional banks and start using CurrencyFair for better rates and lower fees.

-

Plan ahead, monitor exchange rates, and save more on tuition payments.

-

Enjoy a secure, transparent, and cost-effective platform designed for students like you.

Ready to Save? Take Control of Your Finances

Your education is an investment in your future, and every penny counts. With CurrencyFair, you can ensure more of your money goes where it matters most. Sign up now and make 2025 your most affordable academic year yet!

.png?width=1170&name=International%20Tuition%20Fees%20Exchange%20-%20Smart%20ways%20to%20save%20(Facebook%20Post).png)