- AIB

- Bank of Ireland

- Barclays

- Halifax

- HiFX

- HSBC

- Lloyds Bank

- Nationwide

- Natwest

- Permanent TSB

- RBS (Royal Bank of Scotland)

- The Co-operative Bank

- UK Forex (now OFX)

- Ulster Bank

- XE.com

AIB

According to AIB, "going abroad, sending or receiving money internationally is less hassle with AIB." Yes, that may be the first time you've ever seen the words "less hassle" written by a major bank.

Going beyond their headline, they say that "the cost of an International Payment is based on AIB's charge and the charges of other banks involved in the transfer, such as Intermediary (Agent) banks and the Receiving bank.". They even reserve the right to throw in some extra charges - "In addition to the international payment charge, account transaction fees will apply." That doesn't sound cheap nor hassle-free. In total it takes AIB over 250 words to explain their fees. After all that, they don't even provide you with a definitive number or percentage for their fees.

We looked further into what the fees and charges are with AIB. If you were to use Allied Irish Bank for a €10,000 transfer, you'd instantly be £105.91 worse off than if you used CurrencyFair.

Bank of Ireland

Huh? It's a little confusing . . . Bank of Ireland says on its website that it offers "Free online international payments". Unfortunately, the special offer then comes with a warning message that reads much like the warning on a cigarette packet: 'Warning: This product may be affected by changes in currency exchange rates.' Well, yes, the product is affected by exchange rates (to the tune of 1.5% to 3% depending on volume) - that's probably why it's called currency exchange. And when it comes to currency exchange, you'd instantly be £98.87 worse off if you sent €10,000 to the UK with them instead of CurrencyFair on today's date.

The Irish Independent summed it up nicely:

"Don't be lured by promises of commission-free foreign exchange as this doesn't always guarantee that you'll get more bang for your buck. Be careful too to check the foreign exchange rate offered by your bank - as many of these rates have hefty margins built into them."

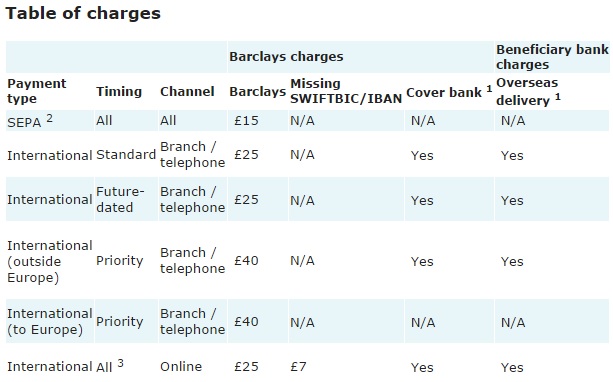

Barclays

Another big well-known bank and, again, more big fees and expensive exchange rates. Using Barclays on today's date to send £10,000 into the Eurozone would cost you a whopping €426.40 over what you'd pay using CurrencyFair.

Barclays display their fixed transaction charges on their International Payments Services page. But that's not all. On top of that is the additional foreign exchange fee which is where most of the charges lie. Barclays don't make it as easy for you to find them.

Halifax

Halifax don't make it easy for you to find details of their exchange rate but at least they are up front with their charges: £9.50 to commence an online transfer and £19.50 to commence a transfer via telephone banking or the old-fashioned way, in a branch. The delivery times range from 4 to 12 days; are they delivering your money by boat?!

The old exchange rate fee is where the charges rake up. A £10,000 transfer to Euro on today's date would be an extra €310.69 than if you'd stuck with CurrencyFair. No wonder Halifax do their best to hide them.

HiFX

HiFX is another company that is taking on the big banks and we applaud them for it. They provide better exchange rates than many companies such as the banks and Transferwise's Express Exchange. Of course, they still cost more than CurrencyFair but then they don't have our unique peer-to-peer money matching system that allows many CurrencyFair customers to beat the international interbank rate. We like the fact that other companies like HiFX are joining us as we take on the big slow expensive banks.

They do, however, state that rates shown on their homepage are "indicative only", and unavailable for private individuals and small/medium business. In other words, they price discriminate, something that CurrencyFair doesn't do.

HSBC

HSBC are one of the largest banks in the world with a market capitalisation of over £120 billion. But they don't always seem to use this scale for consumer good. If you used HSBC on the date of this post to send £10,000 to a country in the Euro zone it would cost you €285.48 more than if you had used CurrencyFair. That's an awful lot of money wasted for a simple online transaction. It doesn't really seem fair, does it?

HSBC are open and honest about their fixed international money transfer fees. But that is only a small part of the overall cost and is used to hook you in. Next time you go to transfer with them, find out the real HSBC exchange rate you are receiving and compare that to the actual exchange rate at that time. Prepare for a shock and make sure that you are sitting down.

Lloyds Bank

Hmmm . . . the Lloyds Bank website claims that you will save a lot of money with them for international money transfers. They even have a fancy calculator. Unfortunately, here's the disclaimer that comes with their calculator:

"The International Money Transfer Calculator is provided for general information purposes and is not intended to provide commercial, financial, investment, accounting, tax or legal advice. All information, content and rates displayed are indicative only and do not represent, nor are intended to represent, the exchange rate or price at which you may be able to purchase or sell currency when using the International Money Transfer Service. As such, you should not use or rely upon the [Lloyds Bank] International Money Transfer Calculator as the basis for any transaction or treat any rates displayed as definitive."

Instead, perhaps you should take a quick look at our pricing comparison table here because using Lloyds for an example transfer on today's date of £10,000 to France would cost you an extra €114.11.

Nationwide

Nationwide have some helpful information on their website regarding the costs associated with sending money abroad.

"There are typically two types of cost when transferring money abroad - banking fees and exchange rates differences. Fees: Usually you are charged a fee for international payments and these will differ according to the service used and the bank or building society that is providing the service. There may also be fees charged by any agent banks involved in the payment transmission before a payment reaches its final destination account. Exchange rates: If you choose to send a Sterling payment overseas, you usually also need to take into account exchange rates for the currency conversion between the two countries as this can affect what is received by the recipient."

We commend their honesty for at least explaining the different charges that their customers face. Unfortunately that doesn't stop Nationwide for excessive charging for international money transfers. If you used Nationwide instead of CurrencyFair to send £10,000 to France (for example), you'd pay €250.93 more.

Natwest

As of today's date (21st May 2015), Natwest's upfront fees for commencing an international money transfer start at £10 for some locations and quickly range up to £30. That's not to mention their exchange rate fees.

This newspaper article about Natwest recommended the following:

"Always compare high street foreign currency rates with those of online providers if you have the time. Ignore “commission-free” deals and “buy-back” offers. These are often bogus as exchange rates will already include markups levied by suppliers."

Sounds like good advice.

And, if you're curious, exchanging an example amount of £10,000 to Euro with Natwest on today's date would cost you a whopping €592.87 more than if you'd used CurrencyFair.

Permanent TSB

This newspaper article included Permanent TSB in review of bank-provided currency exchange:

"Don't be lured by promises of commission-free foreign exchange as this doesn't always guarantee that you'll get more bang for your buck. Be careful too to check the foreign exchange rate offered by your bank -- as many of these rates have hefty margins built into them."

RBS (Royal Bank of Scotland)

Ouch! Of all the international currency exchange companies we're looking at in this list, RBS are the most expensive. Just exchanging an example amount of £10,000 into Euro would cost you an extraordinary €435 more than if you'd used CurrencyFair (Dec 9th 2015, 11.30am).

€435 more than CurrencyFair! What could you buy with €435? Definitely some new shoes. Perhaps a nice little weekend getaway somewhere nice? Lots and lots and lots of chocolate cake? You get the idea.

The Co-operative Bank

Well, it's not what you'd expect to hear from an FAQ page when you're about to send money abroad:

"Please note, all foreign transactions are done at your own risk. We will do everything that we can to get the funds to the receiver with the information that you provide."

Also, this wasn't great:

'Unfortunately we do not have the facility to display our exchange rates daily on the website.'

Ok, well how much will it cost? To send an example £10,000 to France with the Co-operative Bank will cost you €240.44 more than if you use CurrencyFair.

OFX

We like the fact that OFX (previously known as UKForex) are taking it to the big banks and trying to be more reasonable when it comes to online international money transfers. Whilst they are still a lot more expensive than CurrencyFair, they are cheaper than the big banks and we applaud them for their efforts. Of course, there's room for improvement. An example £10,000 international money transfer from the UK to France would cost €111.25 more than if you used CurrencyFair.

Ulster Bank

This newspaper article included Ulster Bank in review of bank-provided currency exchange:

"Don't be lured by promises of commission-free foreign exchange as this doesn't always guarantee that you'll get more bang for your buck. Be careful too to check the foreign exchange rate offered by your bank -- as many of these rates have hefty margins built into them."

We agree. The trick is to look out for the exchange rate they give you, and compare it to the amazing exchange rate offered by CurrencyFair. Our exchange rate is so good because of our 'people power' (is it too late for us to copyright that phrase?) - our unique peer-to-peer money matching system provides you with well-deserved savings. Check out our Currency Exchange Calculator.

XE.com

XE was the brainchild of Steven Dengler and Beric Farmer, who in 1995 introduced the web's dominant currency converter to the world. Since then, they've gone from strength to strength and are rightly proud to be

"...one of the last remaining independent first-wave Internet companies around".

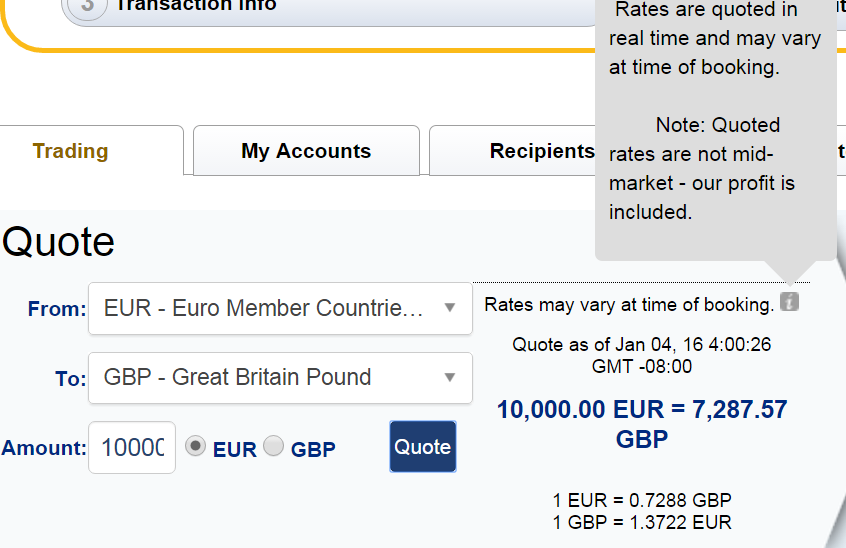

Once registered with their site, the numbers and rates you see are the real rates your transfer will realise - and we like that transparency. However, in terms of saving money, you'd be £69.93 better off using CurrencyFair when sending €10,000 to GBP (January 4th 2016, 12:00pm).

£7,287.57 (XE) v £7,357.50 (CurrencyFair)