Tips on how to diversify your portfolio: Our Simple Guide

International investing is a smart way to diversify your portfolio and protect your assets against regional volatility.However, there tends to be a steep learning curve when deciding where to put your money and why.

Use this guide to learn why you should be investing internationally, how you should do it, and some best practices from the experts.

What is International Investing and Why Should you do it?

International Investments Increase Diversification

Investment educator Paul Merriman at MarketWatch explains that diversity is a key part of investing, and ignoring international markets would be like ignoring a major industry or failing to consider a company’s size in the rest of your portfolio.

“Investors have better long-term outcomes when they diversify widely among asset classes,” he writes.

"...Many academics also have concluded that it’s a bad idea to have more than half of your equities in stocks from any one country.”

The majority of investors have a “home bias” where they only want to invest in stocksand bonds in their home country; when in fact, international stock diversity leads to better-informed decisions with your regional portfolio.One of the most important points when considering investing internationally is how the world reacts to current affairs.For example, with regard to European stocks in particular, along with Brexit, cultural differences continue to make European stocks a risky choice as nations are pulled apart by economic differences of finance, labor, and immigration.

Smart Investors Have a Long-Term Focus

Despite the current instability in the world, there will always be war, political upheaval, and economic downturn.

International investors would be wise to have a long-term plan with their investments instead of hoping to cash in on another region’s misfortune.However, economic instability doesn’t have to be a reason to avoid investing. According to Tim Maverick at Wall Street Daily, Europe’s economic growth has slowed to a crawl this year, earnings are stagnant, and distrust in the banks is leading to spiraling interest rates.

This can be good news for investors who aren’t in Europe who are looking to take advantage of the opening.“To me, the discounted rates of European stocks, when compared to the U.S. prices,and their higher yield make for an interesting and exciting time to invest in Europe,” he writes.This year’s weakness makes Europe much more approachable as an investment opportunity than previous years.Essentially, there’s danger when investing in any corner of the world.The key is to have a long-term plan that can survive temporary downturns and a diverse portfolio that balances risk with reward.

Financial Advisors Can Fill Education Gaps

One of the bigger challenges of investing internationally is education.It’s hard to keep track of one country’s economic outlook, much less the entire world’s. This is especially convoluted when each region uses different metrics to determine stability and success.The Marshall News Messenger recommends going through a financial advisor whose job it is to stay abreast of market fluctuations.

Another option for money management is working with robo-advisors that use a series of risk-factor analyses and algorithms to determine where your investments should go.If education is the biggest barrier to entering international markets, these options are a great place to start.

Consider Different Countries, Not Just Continents

When you consider investing, don’t limit yourself to regions such as the EU and Asia.It’s possible to get into the nitty-gritty and invest in specific countries that match your risk tolerance and goals.Asia and Europe are incredibly diverse, and you shouldn’t judge individual countries by their collective performance.Furthermore, countries that seem stable on the outside might have problems stewingin the next several years.

It should also be noted that every country offers different levels of protection for investors.According to the National Bureau of Economic Research, one reason for this is differences in legal interpretation.“The common law system [of England] allows judges to apply general principles and legal precedents to alleged investor abuse ‘even when specific conduct has not beendescribed or prohibited in the statutes,’” it writes.“Civil law [of France] requires judges to base their rulings on the exact letter of the law.”This means England has some of the strongest protections of outside investors, while France has the weakest.This also shows that economic stability shouldn’t be the only choice investors evaluate when it’s time to buy or sell.

There Are Benefits to Investing Off the Beaten Path

You don’t have to stick to big countries such as Japan, France and America when you start investing.It might be better to skip these economies altogether and opt for a smaller one instead. Liz Smith at SmartAsset recommends investing in smaller markets if you don’t have a large portfolio and are worried about competing with European and American behemoths. “Investing abroad can also give you the chance to put your money into emerging markets in countries that aren’t as developed,” Smith says. “...Stocks in these markets are quite inexpensive and although they haven’t performed well in years, things could turn around in the future.”

If you’re unsure about volatile markets of specific countries, consider investing through a trust.These companies work to invest your money in multiple markets across Asia and companies within them.

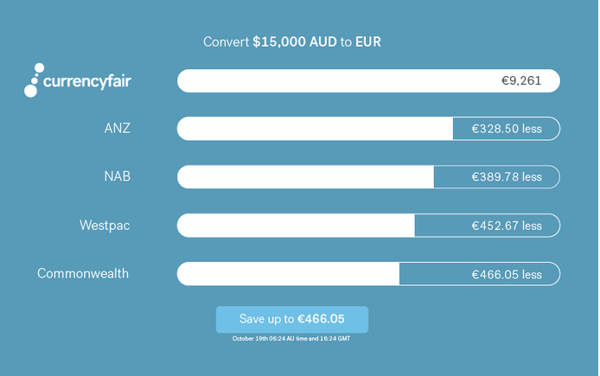

Wait for the Optimal Currency Level to Sell

As InvestorGuide.com points out, investing internationally means juggling investments across companies, countries, and currencies. While you might be tempted to pull your income out of one country because of lower-performing companies, you could get dinged with the conversion rates. “To invest internationally, you must exchange your [money] for the currency of the country in which you plan to invest — and when you sell, the money gets exchangedagain,” the site says.“This adds another level of investment risk to your overall ROI.”Even if you made a profit, you could be losing money due to poor exchange rates.

These are just a few best practices for getting your international investment portfolio started.Investing can ensure you have a long and happy retirement, or help you live off your earnings while you travel.It’s all about setting realistic goals, planning for the long term, and taking a little risk.

New customers from InterNations get 10 Free Transfers

Images by: ©rawpixel/123RF Stock Photo, geralt, diema, steven_yu