A Guide to Avoiding PayPal's Conversion Fees for InterNations Members (2019 Edition)

PayPal is a popular way to send and receive money and to pay for purchases online – it’s fast, convenient, and simple way to handle online financial transactions. However, one very significant downside – especially if you are using PayPal to transfer money abroad – is their unfavourable exchange rates and transfer fees.

In times past, PayPal has been a trailblazer for the spread of online commerce. However, as a way to send money from one country to another, PayPal exchange rates are not bringing value or savings to their customers. What’s more, these rates are often hidden in reams of meticulous terms and conditions. Even third-party sites like Monito do a far better job of explaining the process than PayPal’s own site – it is in their best interest to conceal the expense of their service.

As we shared in our recent article called Money Transfer Companies Compared, Paypal has been great for spreading online commerce but as a way to send money from one country to another, PayPal exchange rates are not bringing value or savings to their customers.

Some people still believe that PayPal is free for currency exchange. It’s not – on the contrary, it’s actually very expensive.

How to avoid PayPal’s money transfer conversion fees

When transferring money in a foreign currency, there is always going to be a fee for that service. While PayPal may appear to be highly efficient and user-friendly, it actually has costs which are similar to that of a traditional bank.

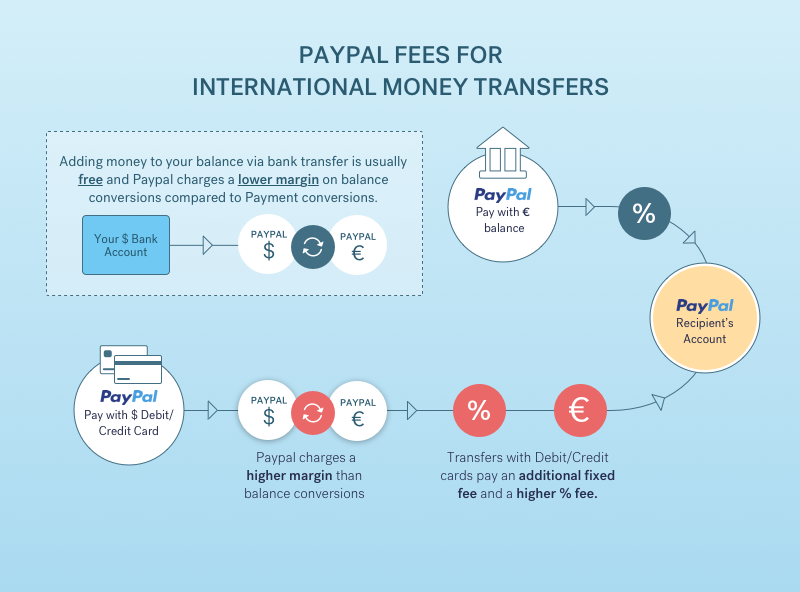

A traditional bank is typically the most expensive way to send money abroad. They take the standard exchange rate (known as the interbank rate) and then add a hefty margin on top. They then tack on an expensive sending fee for the honour of sending the money. PayPal’s transfer model is similar, with some added layers of charges. See illustrated in the below infographic:

So, regardless of the inter-currency transfer, there will be a fixed fee ranging from £1.99-£3.99 added to the transaction, as well as a currency conversion charge (an added 3%–4% of the currency market rate) which is rolled into the exchange rate. This is quite similar to the charging structure of a typical bank.

In contrast, CurrencyFair beats both PayPal and the banks by charging €3 (or its currency equivalent) as a fixed charge on each transfer, and on average adds only 0.45% onto the Interbank rate, as opposed to the 3%–6% expected in traditional financial institutions.

PayPal’s intricate system is full of variables which make transfer calculations clunky, or even discouraging to the user. As seen above, if a transfer is made direct from a credit or debit card using PayPal, separate charges will be incurred: These include a 3.4% charge onto the amount being transferred, on top of a fixed fee for the nature of the transaction.

In contrast, making an Express Deposit into a CurrencyFair account will cost as little as 0.25%–0.5%, depending on the currency being lodged.

See how we compare to other online money transfer companies

Why is CurrencyFair so Much Cheaper than PayPal?

CurrencyFair’s model for making international transfers was designed with maximum savings in mind. Learn more about how we keep our exchange rates competitive in the video below:

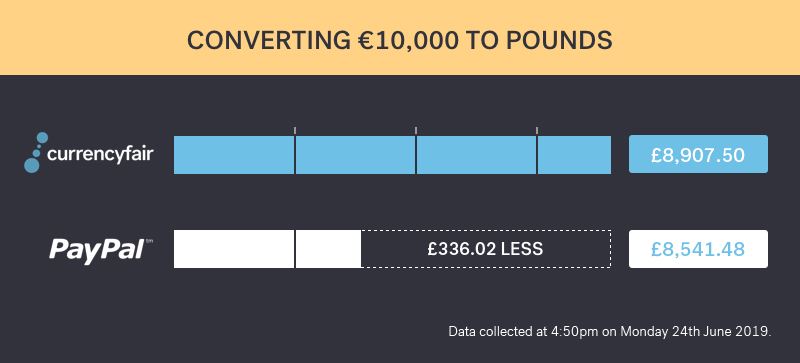

To demonstrate this, we compared the conversion of €10,000 to pound sterling (GBP) on both PayPal and CurrencyFair. This how much you could be saving with CurrencyFair, all while avoiding PayPal’s hidden fees (updated June 24th 2019):

As much as hundreds could be saved by switching up the choice of service for money transfers. If you need to make an international money transfer, we advise staying away from PayPal and enjoy the savings at CurrencyFair instead.

CurrencyFair offers an exchange rate that is usually as close as 0.45% to the Interbank rate. Most high-street banks, brokers and even PayPal hide their charges in their exchange rate, which can then be as far as 3%–6% away from the same rate.

How CurrencyFair is different:

-

Our bank-beating exchange rates mean you avoid hidden mark-ups and excessive fees charged by banks and brokers, helping you send money up to 8 times cheaper than with a typical bank.

-

With CurrencyFair you get the best available rates every time you need to exchange money and unlike traditional providers, we have no minimum or maximum amount.

-

You can do all this in your account anytime, anywhere on CurrencyFair.com, or from our iOS or Android apps.