Are you thinking about a move abroad?

Many CurrencyFair customers have made the leap to life in a new country and are loving it.

If seeking to land a new job before you arrive, one of the key challenges for you or your new employer will to be to work out what salary level you'll need to maintain your current standard of living.

The process involves consideration of differentials between your home country and host country of several key elements: Income taxes, Employee/employer compulsory social contributions, Cost of living, Housing costs.

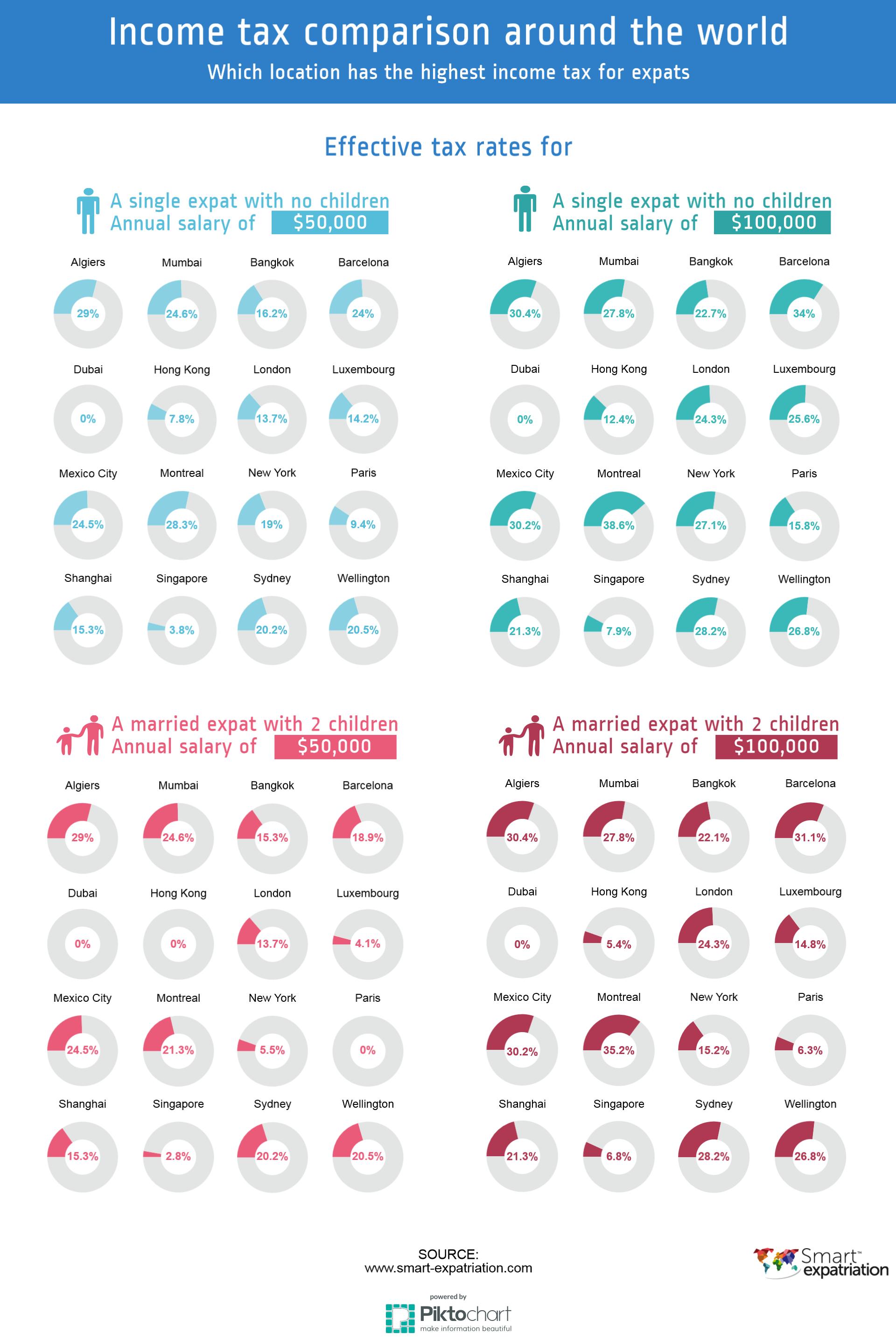

The international cost of living assessment service, Smart Expatriation recently took a look at one of the key components of a net salary: income tax.

The infographic below highlights the differing income tax rates you'll find in various cities around the world.

For more information on international cost of living, check out Smart Expatriation.