Starting a new life abroad can be a huge step forward, that results in great rewards - when done right.

It can provide the opportunity to start afresh and live the life you've always dreamed of.

For many, this picturesque life has been found in Switzerland. Switzerland has consistently retained its notorious reputation for being a global hub of finance, business and great quality of life, endorsed by high salaries, beautiful scenery and great opportunities. Switzerland is a country suited to all expats, whatever you are looking for in your new beginnings.

But before you move, it is a good idea to understand how expensive it is to live in Switzerland compared to other countries in 2018.

We breakdown the cost of living across Switzerland and examine how much you could be paying if you are looking to buy, rent, commute, dine out or just take a taxi there:

First we look at the cost of living in Switzerland compared to other countries.

Switzerland Cost of Living Survey :

Switzerland is ranked in first position with a ranking of 87.33 in this mid-year 2018 Numbeo cost of living survey, which is almost 54% more expensive than the cost of living in Australia which took 10th place at 56.71. This index measured the cost of living which is for things like groceries, restaurants, transport costs plus accommodation costs like rent or a mortgage.

For many expats, a move overseas means enhanced career opportunities for them, an improved quality of life and new experiences and places to see with friends and family.

With the average monthly salary in Switzerland coming in at approximately Fr 4,809 after tax according to a Numbeo July 2018 comparison, a move to Switzerland should be compared against potential average earnings in other countries. For example the average monthly salary in the UK is calculated to be over 51% less than what you would earn in Switzerland, being measured at approximately Fr 2,354. Or when compared with Ireland, you’re earning on a very similar salary with the UK, earning approximately Fr 2,523 per month after tax.

Another unit this survey measured was relative purchasing power for buying good and services in a given country for the average wage in that country. Here Switzerland scored well, taking fourth place in the international rankings.

Best cities for Expats in Switzerland

When planning a move to Switzerland, expats decide where to live depending on their life stage - whether they are looking to live in a busy urban setting or want a relaxed home in the suburbs for their family.

A 2017 Internations 2017 expat city survey profiled the world’s leading expat cities and found Swiss cities making the rankings for expats. More than 13,000 expats took part in the survey, sharing their views on what’s great about the city they’re living in.

The Swiss cities of Basel, Geneva and Zurich were heavily featured in the worldwide rankings for the Quality of Life the cities offered, and impressed expats with their safety and political stability:

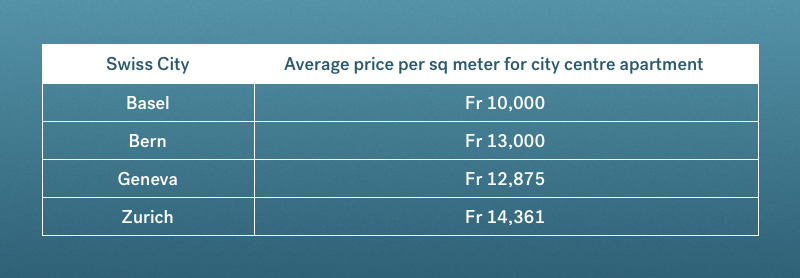

How much does property cost to buy in Switzerland?

With property prices in Switzerland expected to stabilise in 2018, there are still risks to buying. Changes were proposed to the Swiss Federal Act on Acquisition of Real Estate by Persons Abroad (or the so-called Lex Koller) in 2017. However in 2018, the proposal to enforce stricter controls on foreigners buying property in Switzerland was rejected due to concerns it would hinder economic growth.

If the price tag on Swiss properties is beyond your budget, renting is a popular option for many expats who move there.

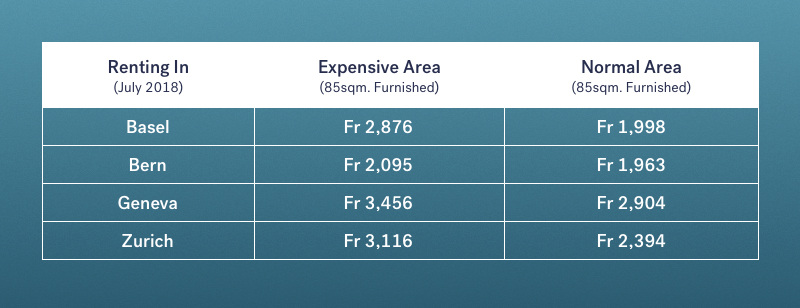

Renting in Switzerland

If buying is not in your plans, renting is an option, albeit an expensive one, for most expats moving to Switzerland.

Prices vary from city to city and even within the same neighbourhoods. One upward driver of these prices is the lack of supply of available properties to rent in the main Swiss cities - people are hesitant to leave where they are renting, for fear they will be paying more rent in their next home. However this means no one is vacating properties leading to a poor supply of stock to rent and in turn, a higher rent being placed on any apartments or homes that are available. This is a vicious circle that is hiking rents up for locals and expats in Switzerland. According to thelocal.ch, new renters can expect to pay as much as 82% more than existing renters.

With this in mind, it is important to be aware of the value on offer in each city and what type of property you can afford before you move to Switzerland.

Comparing Swiss rental prices across popular expat cities using the cost of living calculator on expatistan.com, the cost to rent in a “normal” area in Zurich would be almost 20% more expensive than if renting in the same size apartment and area in Basel.

After choosing your accommodation type and finding a place to live, there are other monthly or weekly expenses you will have to consider depending on where you live.

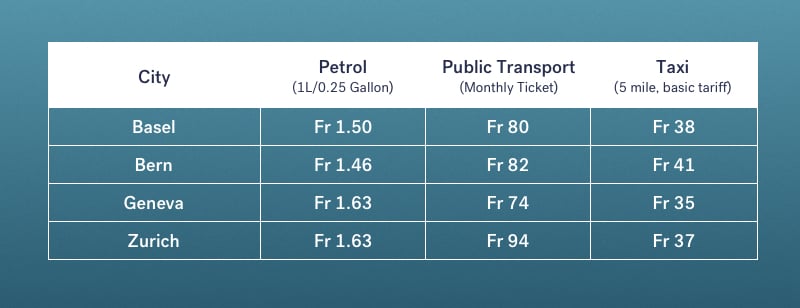

Travel and commuting costs in Switzerland

When comparing Swiss cities for their cost of living, it is important to assign part of your budget to the cost of your daily commute.

You can get to work by bus, train, tram or bicycle when you move to Switzerland or another option is to invest in a car, scooter or motorbike to get around.

If you are planning to move with your car to Switzerland, read our guide to relocating with your car here.

Here is a breakdown of the costs you might be expected to pay for all these commuting or travel options from expatistan.com:

Health and fitness in Switzerland

There is a huge choice of indoor and outdoor activities and hobbies to take part in throughout Switzerland.

The Swiss love to get outside to take part in a variety of sports and have a strong focus on health and “wellness”. From ice-skating and skiing in winter, to hiking and biking in the summer - there are endless choices and ways to get your heart rate up in Switzerland.

If outdoor exercise is not enough or bad weather is stopping you from getting out, prices for joining a gym range from city to city in Switzerland. Generally you can enjoy working out indoors with a one month gym membership for Fr 100 in Basel, Fr 95 in Bern, Fr 85 in Geneva and Fr 101 in Zurich according to expatistan.com

For expats moving to Switzerland, another Numbeo index to note is the Health Care Index which ranks countries based on the quality of their healthcare systems. Here Switzerland had a ranking of 72.24 taking 23rd position in these global rankings, behind the UK in 17th position with 74.12 and quite a distance ahead of the USA in 32nd position, with an index of 68.89.

All this means that for any illness or medical treatment you (hopefully won’t, but) may require while in Switzerland, you are in good hands

How expensive is dining out in Switzerland?

Switzerland has embraced and adopted all types of international cuisine to cater to the huge expat community living there. It is never hard to sample some tasty evidence of this in any of the major Swiss cities.

Dinner for two in an Italian restaurant in a typically expat area including appetisers, main course, wine and dessert will cost you around Fr 100 in Bern compared with approximately Fr 102 in Basel, Fr 113 in Geneva and Fr 118 in Zurich according to Expatistan rankings.

The ultimate expat test in any city is the price of a cup of coffee. Your morning cappuccino in an “expat” area of any these cities will cost you the most in Zurich, where the average price is Fr 5.49, followed by Fr 5.09 in Basel and Fr 5 in Geneva with Bern coming in cheapest at Fr 4.43.

It’s not all work and no play when living in Switzerland. For a Saturday night at the movies, two tickets will cost you around Fr 37 in Bern and Zurich, Fr 38 in Basel and slightly more at Fr 41 in Geneva.

Is moving to Switzerland a good idea?

Even though Switzerland tops the rankings for its cost of living, there is the opportunity to earn more when working there. Surveyed expats report the quality of life, high level of safety and political stability make Switzerland a top choice for people from all over the world and offer amazing opportunities for anyone planning to move there.

For when you need to transfer savings to Switzerland or send money from Switzerland, CurrencyFair offer you the support, speed and great exchange rates for your money transfers.

Banks hide their fees in poor exchange rates, often charging as much as 3%-6% in excessive margins. CurrencyFair is around 0.45% away from the interbank rate meaning it's up to 8x cheaper for you to transfer money to and from Switzerland with CurrencyFair.

CurrencyFair is ideal for expats who need to:

-

Send regular savings home.

-

Relocate and setup expenses.

-

Make mortgage payments and other property expenses.

You get the best available rates for your international money transfers. If you want to request a rate, you can do so in our unique peer-to-peer exchange - request a rate and wait to get matched.

We hope this information will help you in your plans to move to Switzerland - now you have some honest tips and advice to make sure you are getting the best start to your move overseas.

CurrencyFair specialise in being transparent and fair at all times - like when we are sending money overseas.

See how much you can save when using CurrencyFair to send money home from Switzerland.

%20(1).jpg?width=600&name=tim-trad-BYPMtjYMEyk-unsplash%20(2)%20(1).jpg)