If you needed to conduct an international money transfer prior to 1973, the chances are you would complete the transfer with telex, a slow and somewhat costly process that was also prone to human error. That all changed with the introduction of the Society for Worldwide Interbank Financial Telecommunication, more commonly known as SWIFT.

SWIFT established a secure and standardised way for making an international money transfer, thanks to the use of standardised code through which two banks could communicate, regardless of location, currency or language.

Sending money overseas? Save money when you send money with CurrencyFair's low-margin FX rates.

What is SWIFT?

SWIFT is essentially a messaging network, owned by member financial institutions with the goal of facilitating seamless, transparent cross-border transfers. Currently, some 11,000 institutions in over 200 countries use SWIFT to process more than 35 million transactions per day.

Consumers don't need to worry about the processes whirring away behind the scenes. All they require to make a transfer is an 8- or 11-character SWIFT code that uniquely identifies a destination account and bank.

You too can speak SWIFT!

There's a satisfying logic to the creation of SWIFT codes for each financial institution. The first four characters identify the bank, the next two letters indicate the country, and the last two indicate the city. If there are several branches of a bank within a city, an 11-character code might be required, with the additional three characters at the end identifying the target branch in question.

Who uses SWIFT?

Whereas international money transfer was once the domain of Treasury transactions, SWIFT now serves banks, foreign exchange and money brokers, brokerage institutes and trading houses, securities dealers, asset management and more. In that sense, it's the go-to service for both individual account holders sending double-digit amounts and illustrious financial institutions wiring millions. Whatever the sum involved, SWIFT remains the messaging network only. It doesn't manage accounts or process transactions. That task falls to the bank.

How does a SWIFT transfer work?

One of the benefits of SWIFT as a wire transfer solution is that security and transparency are built into each transaction.

In order to initiate the transfer, the bank will first have to confirm the identity of the sender to meet Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Next, the bank or money transfer service will quote the exchange rate for the transfer. Once the sender has accepted this rate, the bank will complete the transfer using the SWIFT code of the destination bank and debit the sender's account for the amount plus exchange and transfer fees.

Typically, a SWIFT transfer takes one to five working days to land in the destination account, or longer if the money has to be routed via an intermediary bank. That means SWIFT is not the best option if the transfer has to be made instantly or even on the same day.

SWIFT fees

The cost of a SWIFT transfer can add up too, especially for transfers of larger amounts. The sender will typically pay their bank fees, while the recipient will also be charged a fee at their end (although there is usually the option for the sender to pay all fees associated with the transaction). Where an intermediary bank is required, there might also be interbank fees, and if you want a fast-track service expect to pay a priority fee too. As secure and safe as your money is with a SWIFT transfer, it's by no means the cheapest way of sending money overseas.

What do you need to make a SWIFT transfer?

If you're making a wire transfer at the bank branch (usually for an additional fee), the bank will normally take care of identifying the correct SWIFT code for your recipient bank. If you're making the transfer online or through mobile banking, you might have to find it yourself. It should be featured on the destination bank's website or statements. For peace of mind, go to the source rather than putting your faith in the vast array of websites that (correctly and incorrectly) list the codes for each country.

To make the transfer, you'll generally need:

-

The recipient's name and address as featured on their account.

-

The name and address of the receiving bank (as featured on their website).

-

The SWIFT code of the receiving bank (you might see it referred to as the Bank Identifier Code or BIC).

-

The recipient's account number or International Bank Account Number (IBAN).

The SWIFT code identifies the bank and the IBAN identifies the specific account. You'll need both to make a wire transfer.

How you can save on a SWIFT transfer with CurrencyFair

CurrencyFair is generally able to bypass SWIFT and its associated transfer fees by using a network of banks based locally in the originating and destination countries.

For example, if you need to send money from Germany to the United States (US), this is the process that your currency exchange undertakes:

-

You send money into your CurrencyFair account, which will use CurrencyFair's local EUR bank account.

-

If you select “Exchange Now” or get a match on the CurrencyFair Marketplace, we exchange your euros into US dollars (USD).

-

You'll then see US dollars in your CurrencyFair wallet. You can then initiate a transfer to your recipient in the US.

-

We then send the amount you want to transfer from our USD account in the US to your recipient.

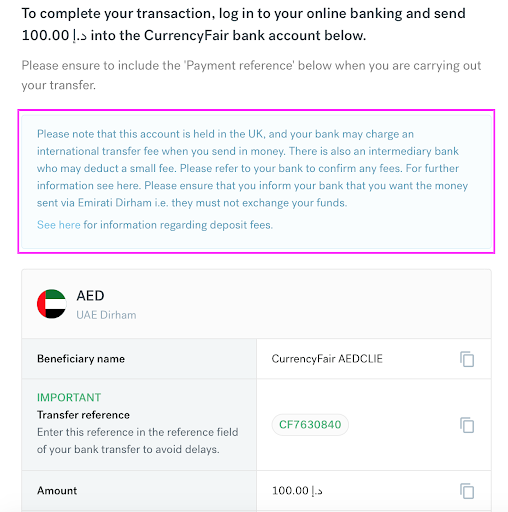

CurrencyFair does use the SWIFT network for some transfers - if you want to add South African Rand or Canadian Dollars to your account, for example, that may require the use of the SWIFT network, or if you need to transfer United Arab Emirates Dirham or Israeli New Shekels.

However, we work to reduce SWIFT's intermediary fees and are always fully transparent if there are going to be any fees you need to know about. You'll be shown a warning like the one below if you will be affected and you can use our estimation tool here as well.

An example of what a person transferring United Arab Emirates Dirham into their CurrencyFair account would see on our app. Accurate as of 15 December 2021.

We mentioned that banks charge a number of exchange and transfer fees on every cross-border money order, typically around 3 to 5% on the exchange rate. Are they getting you the best deal? Don't count on it. Most of the big-name banks will offer an exchange rate that compares poorly with the daily currency market rate and few offer any kind of advice or tools for calculating the best time to make an international transfer.

With CurrencyFair, you can bypass your bank altogether, skip their fees, and get the real-time exchange rate. When your money is on the move, we help it go further.

This information is correct as of 15 December 2021. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes. Photo by Thought Catalog on Unsplash.

%20(1).jpg?width=600&name=tim-trad-BYPMtjYMEyk-unsplash%20(2)%20(1).jpg)